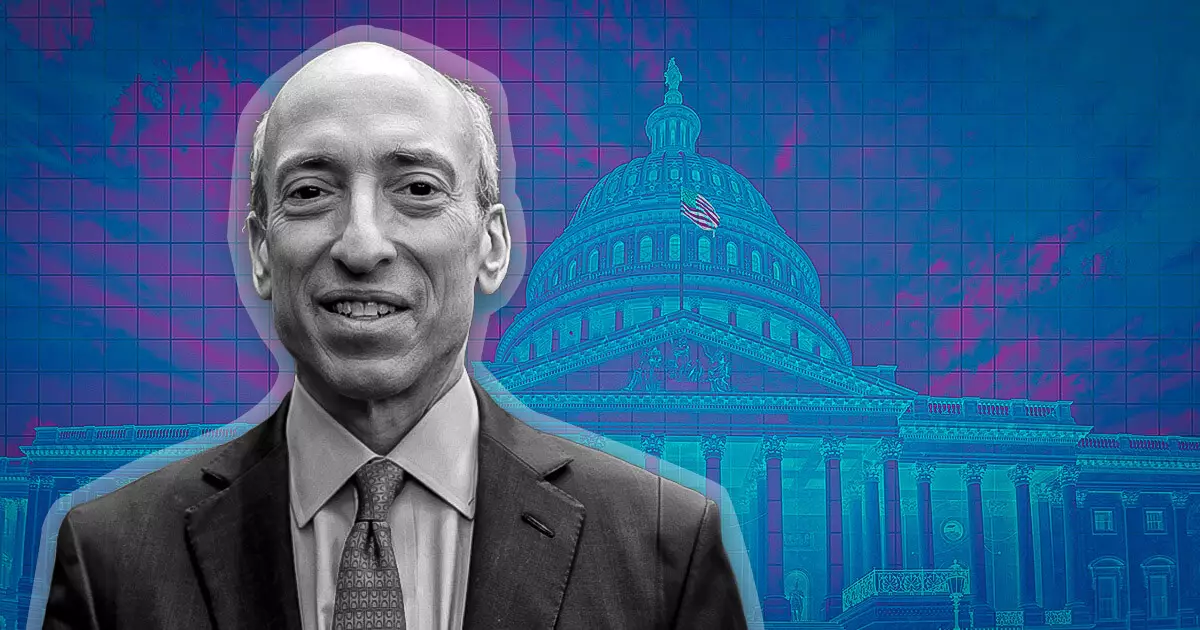

The U.S. Securities and Exchange Commission (SEC), under the leadership of Gary Gensler, has recently come under heavy scrutiny, particularly from figures in the cryptocurrency industry. One such critic, Tyler Winklevoss, co-founder of the Gemini crypto exchange, has publicly lambasted Gensler’s approach, claiming that his actions are anything but benign missteps. Rather, Winklevoss argues that Gensler’s conduct is a calculated effort to advance a personal political agenda, often at the expense of consumer welfare and the broader cryptocurrency sector.

This clash raises essential questions about the balance between regulatory oversight and the necessity for an innovative financial landscape—especially in a rapidly evolving domain like cryptocurrency. Winklevoss’ assertion that Gensler was “nuking an industry” necessitates a closer examination of the implications and consequences of such regulatory attitudes.

The criticisms leveled by Winklevoss extend beyond mere discontent; he emphasizes the tangible repercussions stemming from Gensler’s regulatory maneuvers. The former Olympic athlete ventures that Gensler’s indifference toward the potential loss of jobs and investment capital reflects a broader problem in how regulatory frameworks intersect with nascent industries. By dismissing the livelihoods of thousands, Gensler invokes a chilling narrative for entrepreneurs and investors who dare to tread in the relatively uncharted waters of cryptocurrency.

Winklevoss, articulating that Gensler’s actions have inflicted “irrevocable damage” upon the crypto space, invites us to ponder the long-term ramifications of overly stringent regulations. This has led many to question the motive behind Gensler’s high-stakes regulatory approach, which critics argue could stifle innovation and deter investment in a sector poised to transform modern finance.

The dissatisfaction surrounding Gensler’s conduct is not an isolated sentiment. It resonates with a growing chorus of dissenters, including a recent legal challenge launched by 18 U.S. states against the SEC, which alleges “gross government overreach.” Such opposition suggests a fragmentation of confidence in regulatory bodies, primarily when rulings perceived as punitive jeopardize the entire industry’s viability. As Winklevoss argues, the narrative of government agencies meant to serve the public turning into instruments of personal ambition is a troubling one.

During the previous election cycle, then-Republican President-elect Donald Trump pledged to remove Gensler upon returning to the office, showcasing the political ramifications of his regulatory stance. This promise indicates a larger discontent among policymakers, as the crypto community finds itself caught in the crossfire of political agendas. Trump’s association with the Winklevoss brothers—who notably contributed to his campaign—further cements the political weight of this controversy, suggesting that the battle over regulatory approaches extends beyond ideology to political influence.

With Gensler’s term ending in July 2025, speculation abounds about who could take the helm of regulatory oversight next. Figures like Dan Gallagher and Paul Atkins have emerged as potential successors, which raises the question: can a shift in leadership lead to a reimagined regulatory framework more conducive to innovation?

Winklevoss calls for a boycott of any institution that might employ Gensler post-SEC, underscoring the profound animosity harbored by industry figures toward his tenure. However, this reflects a larger call for accountability and scrutiny within regulatory agencies, urging stakeholders to thoughtfully assess whom they entrust with oversight in the future.

In these turbulent times, as the U.S. grapples with the implications of cryptocurrency regulation, the discourse surrounding Gensler’s leadership serves as a critical reflection of the ongoing tensions between innovation and regulation. While the drive for protective rules is essential, it is equally crucial that governing entities foster environments where new financial technologies can flourish. Ensuring that regulations serve the people rather than infringe on their progress is paramount. The future of the crypto industry, and by extension, its economic impact, hangs in the balance as stakeholders from various fronts navigate this contentious terrain.