The legal skirmish between the United States Securities and Exchange Commission (SEC) and Ripple Labs has taken an intriguing turn, sparking debates within the cryptocurrency realm. The SEC’s recent decision to appeal a federal courtroom verdict has added another chapter to this protracted and contentious battle over XRP, Ripple’s native cryptocurrency. With significant implications for the broader crypto industry, this article seeks to explore the nuances of the appeal, the reactions from Ripple executives, and the wider effects of the ongoing litigation.

On October 2, 2024, the SEC filed a notice of appeal with the Second Circuit Court of Appeals, following a crucial ruling issued in August. This ruling had presented a somewhat mixed bag for the agency, which had accused Ripple of conducting a $1.3 billion unregistered securities offering through its sales of XRP. The court’s decision, which was heralded by Ripple as a partial victory, found that the sales of XRP to retail investors—specifically those made through cryptocurrency exchanges—did not violate securities laws. This aspect of the ruling was particularly significant, as it seemed to support the argument for the classification of XRP as a non-security, providing a potentially precedent-setting moment for the industry.

Despite this partial win for Ripple, the court’s determination that Ripple’s direct sales to institutional investors constituted unregistered securities offerings was a setback for the company, resulting in a fine of $125 million. The SEC had initially pursued a far more substantial penalty of $2 billion, so the lower settlement amount was viewed with cautious optimism within the crypto community. Ripple’s executives celebrated this ruling as a signal of progress against what they see as regulatory overreach.

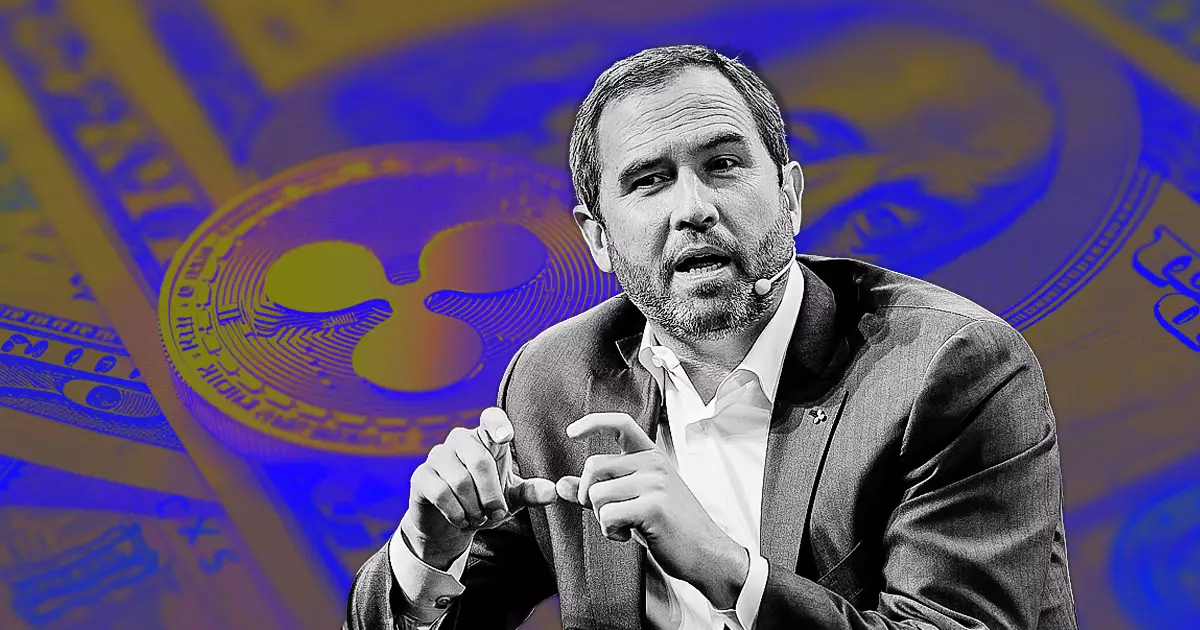

Ripple’s CEO, Brad Garlinghouse, expressed visible frustration with the SEC’s decision to pursue an appeal. He openly criticized the agency for allegedly wasting taxpayer funds on a case that he believes has already addressed the key issues in favor of Ripple. Garlinghouse’s statement highlighted a growing sentiment in the crypto community regarding the lack of accountability within regulatory bodies, particularly under the leadership of SEC Chair Gary Gensler.

Furthermore, Ripple’s Chief Legal Officer, Stuart Alderoty, echoed Garlinghouse’s discontent by emphasizing that the court had confirmed there were “no victims or losses” arising from Ripple’s actions. Alderoty underscored a broader concern—the SEC’s inclination towards what he termed “litigation warfare” against the crypto sector. This rhetoric serves to stoke fears among industry advocates about the implications of sustained legal battles on innovation and investment within the cryptocurrency space.

The SEC’s ongoing appeal is not merely a Ripple issue but resonates throughout the entire cryptocurrency landscape. The outcome of this case has the potential to define how digital assets are classified in the U.S., which could lead to a paradigm shift in regulatory standards. The decision could either bolster or stifle innovation and investment in cryptocurrencies, with potential consequences for startups and established entities alike.

As the news of the SEC’s appeal broke, XRP’s market value dipped significantly—around 9% in a day, reflecting the uncertainty that such legal actions stir in investors. At the time of reporting, XRP was trading just above the $0.54 mark, further emphasizing the volatility inherent in cryptocurrencies, especially under the specter of intensified regulatory scrutiny.

Moreover, the ramifications extend beyond Ripple and XRP. A ruling in this case could influence how other cryptocurrencies are classified, leading to a ripple effect (pun intended) through the ecosystems of various digital assets. It raises critical questions about the retroactive application of laws to emerging technologies and the role of regulatory bodies in shaping the future of the economy.

As the SEC continues its legal pursuit of Ripple Labs, the industry awaits the next developments in this landmark case. Ripple’s leadership remains resolute in its defense, bolstered by a perceived judicial validation of key arguments made in their favor. The ongoing dispute encapsulates broader tensions between innovation-driven sectors like cryptocurrency and regulatory frameworks that some view as outdated or misaligned with the realities of the digital economy.

As stakeholders, from investors to legislators, closely monitor these developments, it becomes increasingly clear that the implications of the SEC’s actions extend far beyond Ripple itself. This case serves as a critical point of reference for the necessary balancing act between fostering innovation and ensuring regulatory compliance, a challenge that will only become more pronounced as the cryptocurrency landscape continues to evolve.