Bitcoin, the leading cryptocurrency, has been experiencing significant selling pressure lately. On July 4, a dormant Bitcoin wallet that had been inactive for 12 years suddenly sprung to life and transferred over $6.8 million in Bitcoin. This wallet, known as 1Nxxi, sent 76 BTC ($4.46 million) in the first transaction and 43 BTC ($2.46 million) in the second to an unknown address (3Ctd5). This unprecedented move has sparked concerns within the crypto community regarding the potential intentions of this whale investor.

The sudden activity from the dormant Bitcoin wallet has raised fears that the whale may be looking to offload its significant holdings. Given the current selling pressure faced by Bitcoin, a sale of this magnitude could potentially exacerbate the situation and lead to further declines in the value of the cryptocurrency. However, on-chain data has revealed that the 119 BTC sent to the unknown address (3Ctd5) remains untouched, providing some relief to the crypto community.

In addition to the mysterious whale activity, the German government has also been contributing to the selling pressure on Bitcoin. According to Arkham Intelligence, a blockchain analytics platform, the German government has been selling off a large amount of Bitcoin, with transactions totaling up to $175 million. Over the past 24 hours, they have moved 1,300 BTC ($76 million) to various exchanges such as Kraken, Bitstamp, and Coinbase, as well as transferring 1,700 BTC ($99 million) to an unknown address (139Po), possibly for institutional purposes.

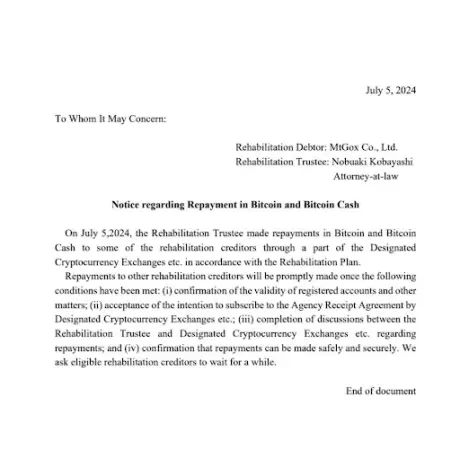

As if the whale activity and government selling were not enough, the defunct crypto exchange Mt. Gox has also come into play. Mt. Gox recently announced that it has started repaying its creditors, with the rehabilitation trustee making Bitcoin repayments to certain creditors through designated exchanges. This development is significant as it is likely to introduce more selling pressure on Bitcoin, as some creditors may choose to liquidate their holdings upon receiving their repayments.

The recent surge in selling pressure on Bitcoin from multiple fronts, including the dormant whale, the German government, and Mt. Gox, has created a challenging environment for the cryptocurrency. Investors and analysts alike will be closely monitoring these developments to gauge the impact on Bitcoin’s price and overall market sentiment.