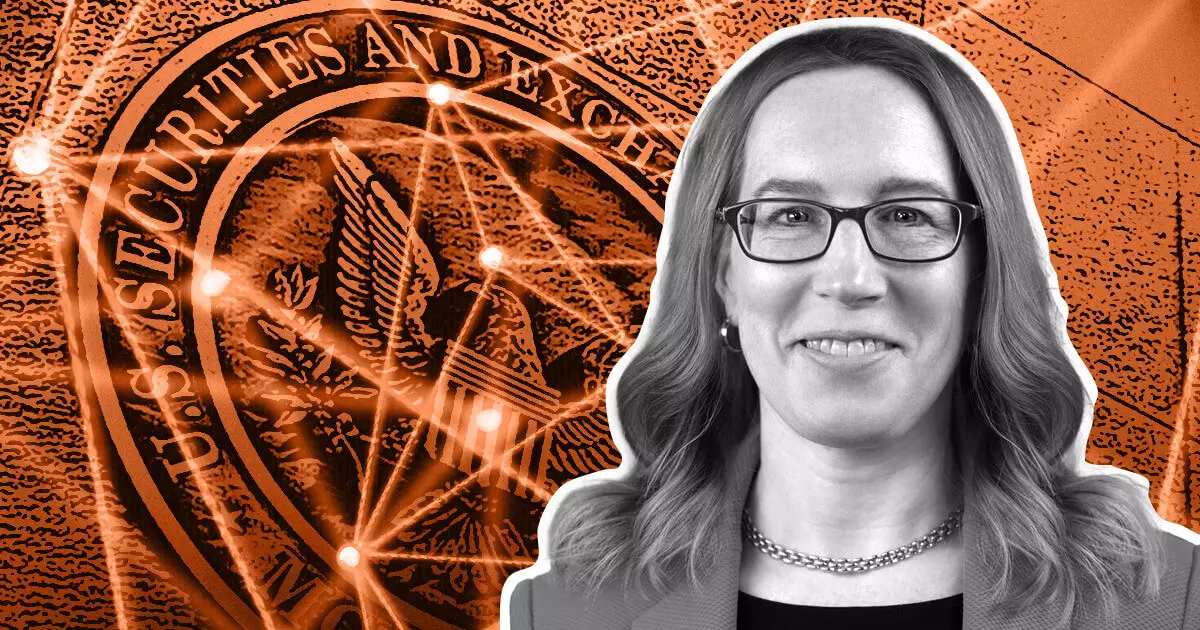

The proposal put forth by SEC commissioner Hester Peirce for a shared digital securities sandbox between the US and the UK presents a unique opportunity for firms from both countries to engage in sandbox activities under similar regulatory conditions. This initiative has the potential to revolutionize how securities issuance, trading, and settlement are conducted using distributed ledger technology (DLT).

Under Peirce’s proposal, participating firms would be able to conduct activities under self-chosen regulation conditions, using the sandbox as a testing ground to build a market case for their products. This would allow them to address any potential design and implementation flaws while simultaneously serving real customers. The sandbox would also aim to determine whether DLT can facilitate securities processes without any negative repercussions.

The SEC’s involvement in the shared sandbox would ensure that participating firms adhere to reasonable conditions, despite being able to select their own regulatory parameters. The program would assign eligible activities based on public input, with firms allowed to participate for a period of two years. The SEC’s FinHub would play a crucial role in helping firms submit participation notices and providing support in navigating the regulatory landscape.

Peirce outlined numerous benefits of the shared sandbox approach, drawing from the success of firms that entered the FCA sandbox in the UK between 2016 and 2019. These firms were found to have raised more capital and survived longer than their counterparts. Additionally, consumers would benefit from quicker market access to innovative products that are typically not readily available to them.

The proposal for a US-UK shared digital securities sandbox comes at a time when the SEC is facing criticism for its enforcement actions against crypto companies under chair Gary Gensler’s leadership. Critics have accused the agency of having political motivations when approving spot ETH ETFs. Peirce clarified that her proposal is a work-in-progress and a response to industry stakeholders seeking to engage in the US market.

Despite the positive implications of the shared sandbox proposal, Peirce’s previous Safe Harbor Proposal, which suggests temporary regulatory exemptions for token issuers, has not made significant progress since 2021. Moving forward, it would be crucial for regulators and industry players to work collaboratively to ensure the successful implementation of the proposed shared digital securities sandbox.