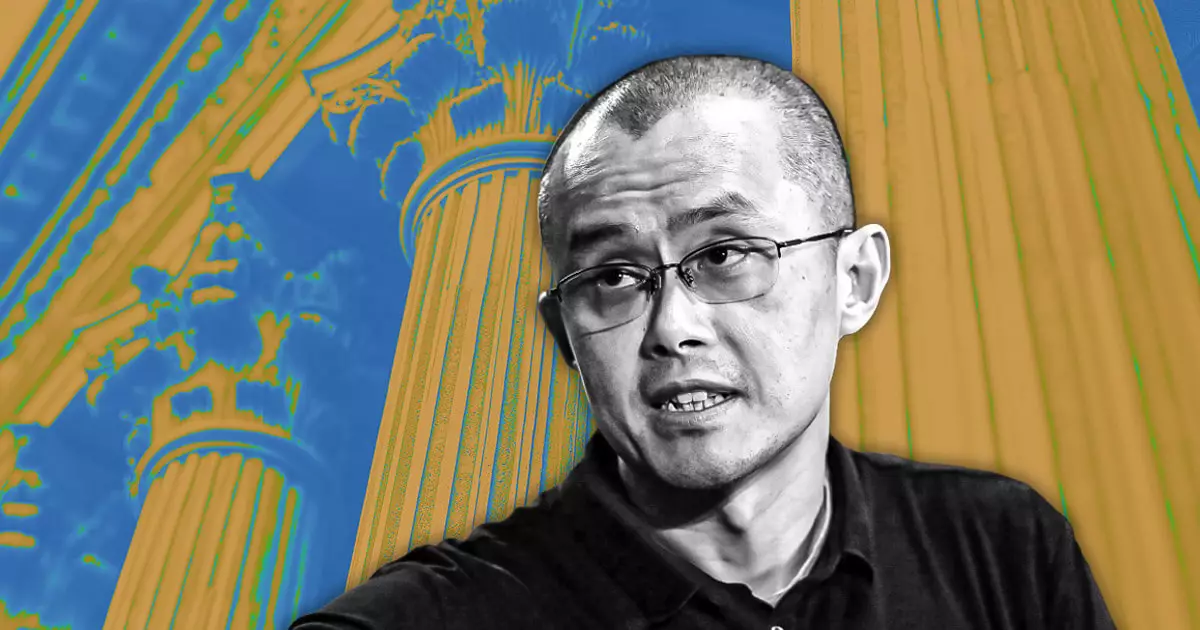

Changpeng Zhao, famously known as CZ, the figurehead of Binance, recently addressed swirling rumors regarding the future ownership structure of the cryptocurrency exchange. While he categorically dismissed claims that Binance is actively seeking a buyer, he opened the door to the possibility of selling a minority stake to investors down the line. This nuanced take on the speculation aligns strategically with the heightened interest in minority investments across the tech industry and could reflect broader market dynamics at play.

The origin of these rumors can be traced back to a specific chain of events that caught the attention of the crypto community. A notable reduction in Binance’s crypto holdings led many to speculate that the company was offloading significant assets, presumably in preparation for a full sale. However, CZ refuted these claims, attributing the fluctuations to internal treasury adjustments rather than a distress signal or indicative of declining financial health. This highlights the ongoing struggle for transparency that companies like Binance face in an environment rife with misinformation and speculative commentary, especially within the competitive landscape of cryptocurrency.

The regulatory challenges faced by Binance, particularly in various international jurisdictions, further exacerbate the scrutiny under which the exchange operates. Speculations intensified after a post on Chinese social media suggested that regulatory pressures and a pivot towards decentralized exchanges (DEXs) could motivate a sale. However, CZ and Binance co-founder Yi He urged caution, clarifying that there are currently no plans to dilute their ownership structure. This implies a more complex scenario where Binance is trying to navigate regulatory waters while maintaining its leading position in the market.

CZ’s mention of potential future minority stake sales is particularly interesting as it suggests a potential shift in Binance’s operational strategy. This prospect indicates an invitation for external funding without ceding control, which could strengthen the company’s balance sheet while enhancing credibility among institutional players. Such investments might offer both financial resources and strategic partnerships, vital for sustaining growth in an increasingly competitive environment.

Despite the backdrop of uncertainty and the ongoing legal challenges that Binance faces, it remains the dominant player in the cryptocurrency space, with significant trading volumes that underscore its operational strength. The interest from institutional investors, coupled with CZ’s willingness to consider external partnerships, paints a picture of an exchange that is not only resilient but also adaptable. As others in the crypto sector pursue decentralized and more regulated models, Binance’s established infrastructure positions it uniquely to evolve while retaining its preeminence.

While rhetoric about a potential sale of Binance may offer more questions than answers, the underlying dynamics of minority investment considerations reflect a strategic pivot that could fortify the exchange’s future without compromising its core identity. The crypto landscape is evolving rapidly, and Binance’s ability to adapt will be critical in maintaining its status as an industry leader.