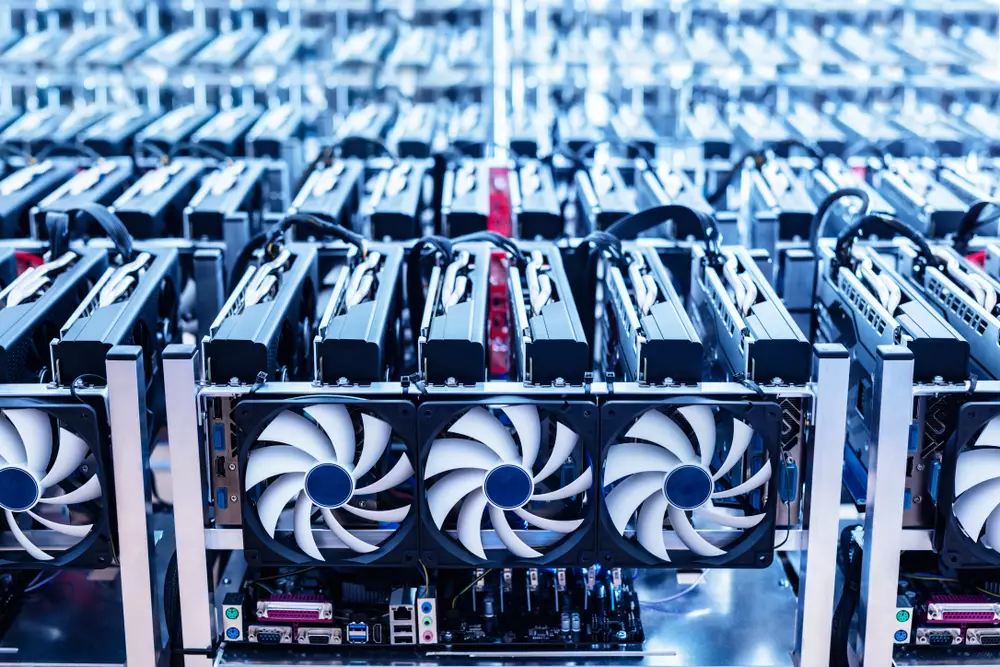

The recent post-halving world of Bitcoin has seen a significant drop in computational power, with hashrate plummeting by 20% in recent weeks. This unexpected decline has sparked a debate among analysts, with some attributing it to a possible fire sale, while others caution against jumping to conclusions. Typically, after a halving event, hashrate increases as miners invest in more powerful rigs to compete for reduced rewards. However, this time around, the trend has defied expectations. Maartunn, a pseudonymous analyst at CryptoQuant, believes that this decline signals a potential “miner capitulation” as less efficient miners may be shutting down their operations due to squeezed profit margins from the halving event.

Hash Ribbons and Miner Reserve

Supporting Maartunn’s theory is a technical indicator called Hash Ribbons, which tracks the difference between short-term and long-term hashrate averages. A widening gap in Hash Ribbons suggests a decline in mining activity, potentially as less efficient miners drop off. This recent hashrate plunge has also triggered a spike in Hash Ribbons, historically a sign of miner capitulation that has often coincided with price lows for Bitcoin. Another factor pointing towards miner capitulation is the decrease in Bitcoin’s Miner Reserve, which tracks the amount of Bitcoin held in wallets associated with miners. A decline in the reserve could indicate miners offloading their coins, possibly to cover operational costs or exit the market altogether.

Opportunities for Investors

Maartunn interprets these signs as a bullish indicator, suggesting that Hash Ribbons often point to opportune moments to buy. He also points to the Market Value to Realized Value (MVRV) ratio, which indicates that Bitcoin may be undervalued. A negative MVRV, like the one Bitcoin currently has, suggests the asset is trading below its historical cost basis, potentially indicating a buying opportunity. However, not all analysts are convinced. Some argue that the hashrate decline could be temporary, potentially due to factors like extreme weather disruptions in mining operations or simply a period of adjustment for miners post-halving.

The post-halving Bitcoin landscape remains fluid, with the hashrate decline and other signs suggesting a potential buying opportunity, especially for long-term investors. While some indicators point towards miner capitulation, it is important to consider all factors before making investment decisions in the volatile cryptocurrency market. The debate among analysts continues, and only time will tell how the post-halving scenario unfolds for Bitcoin.