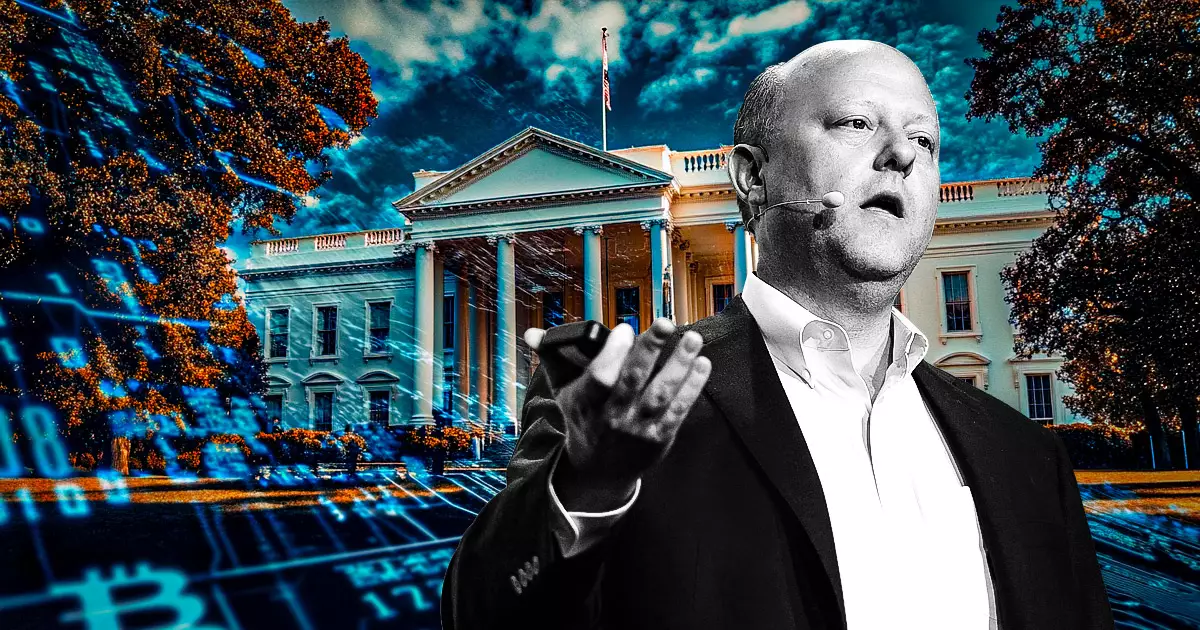

The cryptocurrency ecosystem is often characterized by its volatility and rapid changes, but recent comments from Jeremy Allaire, CEO of Circle, have sparked a wave of optimism among investors and industry leaders alike. Speaking at the Reuters Global Markets Forum during the World Economic Forum held in Davos, Allaire articulated a vision where the policies of President Donald Trump could significantly benefit the cryptocurrency industry. His assertions highlight a belief that Trump’s administration might embrace regulatory changes to dismantle existing barriers to digital asset adoption, thus potentially altering the financial landscape.

Addressing Regulatory Challenges

One of the primary regulatory impediments Allaire noted was the SEC’s Staff Accounting Bulletin (SAB) 121. This policy penalizes banks and financial institutions for holding cryptocurrencies, constraining their ability to fully integrate these assets into their operations. Allaire argued that repealing such onerous regulations is vital for fostering a more inclusive financial system that accommodates digital assets. This perspective underscores the urgent need for regulatory reform, not just for the growth of cryptocurrencies but for the broader financial ecosystem. The Circle CEO’s advocacy for change has been exemplified by the company’s generous $1 million contribution to Trump’s inauguration committee, an act that signals deep confidence in potential advancements in crypto-friendly policies.

Despite Allaire’s hopeful predictions, the actual content of Trump’s inauguration address, which lacked any mention of cryptocurrency, left investors in a state of speculation. Trump’s focus on tariffs, immigration, and energy independence rather than digital assets raised questions about his administration’s immediate plans regarding cryptocurrencies. This uncertainty contributed to market volatility, as seen in Bitcoin’s price fluctuations around the inauguration date. It surged to a remarkable high of $109,000 before correcting to $100,000, with a lingering price of approximately $103,500 reflecting the ongoing investor optimism and interest.

Institutional Interest and Growing Trends

Encouraging data on institutional investments in cryptocurrency further bolsters the optimism within the industry. Significant inflows into Bitcoin exchange-traded products (ETPs) amounted to $1.9 billion, contributing to a total of $2.2 billion in crypto-focused ETP investments. These figures point to a robust demand from institutional players, highlighting a growing acceptance of digital currencies in mainstream finance. The landscape is also becoming more dynamic with the introduction of new tokens, such as the recently launched TRUMP memecoin, which experienced a staggering 490% increase shortly after its debut.

As digital assets intertwine more closely with traditional finance, the potential for a strategic Bitcoin reserve under Trump’s administration has emerged as a topic of speculation. Betting platforms currently estimate a 60% likelihood of such an initiative becoming a reality this year. Overall, the cryptocurrency community remains hopeful that Trump’s presidency could usher in an era marked by regulatory clarity and expansive growth, facilitating broader adoption and integration of cryptocurrencies across all facets of the financial system. The outlook may indeed hinge on how the administration chooses to navigate the complex world of digital assets, leaving many with a sense of anticipation and optimism for the future.