Recent reports suggest that Gemini, the cryptocurrency exchange founded by the Winklevoss twins, is contemplating an initial public offering (IPO) within the year. While sources familiar with the situation have confirmed ongoing discussions about this potential move, no conclusive decision has been made yet. The implications of such a listing are profound, not just for Gemini, but for the broader cryptocurrency industry as it navigates through an evolving financial landscape.

The environment surrounding cryptocurrencies has been significantly influenced by political developments, particularly during Donald Trump’s administration, which many perceive to have been favorable towards cryptocurrency innovations. James Seyffart, an ETF analyst at Bloomberg, noted that an increasing number of crypto companies are likely to consider IPOs in forthcoming years. This trend might stem from a perceived regulatory leniency which can provide potential avenues for growth and exposure in traditional financial markets.

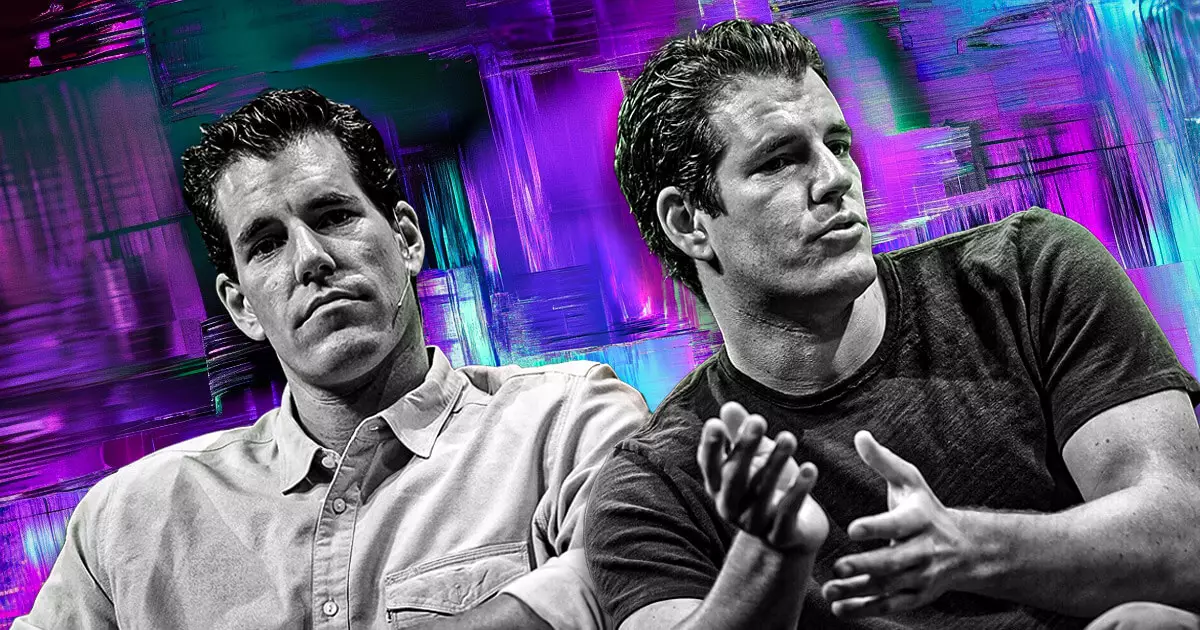

Moreover, the Winklevoss twins have recently made headlines for their political contributions. Their donation of Bitcoin exceeding the legal maximum to Trump’s campaign—although partially refunded—aligns them strategically with a candidate who has shown positive sentiment towards the cryptocurrency sector. Such affiliations could bolster Gemini’s reputation and market positioning in an increasingly competitive environment.

Gemini isn’t alone in eyeing an IPO. Other crypto enterprises, notably Bullish Global, are also evaluating public listing options. Bullish, which has backing from prominent venture capitalist Peter Thiel, reflects a growing trend where financial firms in the digital asset space seek to attract institutional investments through public listings. This renewed interest in IPOs indicates a significant shift that could reshape the future of how cryptocurrency companies operate and engage with the public.

However, these ambitions are not without hurdles. Gemini, like many others, has faced several regulatory challenges in recent years, including a $5 million settlement with the Commodity Futures Trading Commission (CFTC) over misleading statements during its attempt to initiate the first regulated Bitcoin futures contract in the United States. Regulatory scrutiny continues to weigh heavily on crypto firms, compelling them to alter operations in attempts to align with legal frameworks.

In parallel to seeking public listings, Gemini is also undergoing strategic realignments in response to these regulatory pressures. The firm is exiting the Canadian market, marking a growing trend among numerous cryptocurrency firms—such as Bybit and Binance—that have recently scaled back operations in areas with stringent regulations. Conversely, Gemini’s successful acquisition of a license to operate in Singapore signals a strategic pivot towards jurisdictions with welcoming regulatory environments. This adaptive strategy illustrates how firms in the cryptocurrency sector are not only reworking their operational frameworks but are also realigning to seize opportunities in less restrictive markets.

While the IPO aspirations of Gemini represent a pivotal moment for the exchange, they are situated within a broader narrative of regulatory engagement and strategic repositioning within the cryptocurrency landscape. As firms navigate this complex terrain, their future trajectories will likely hinge on the interplay between innovation, regulation, and political will.