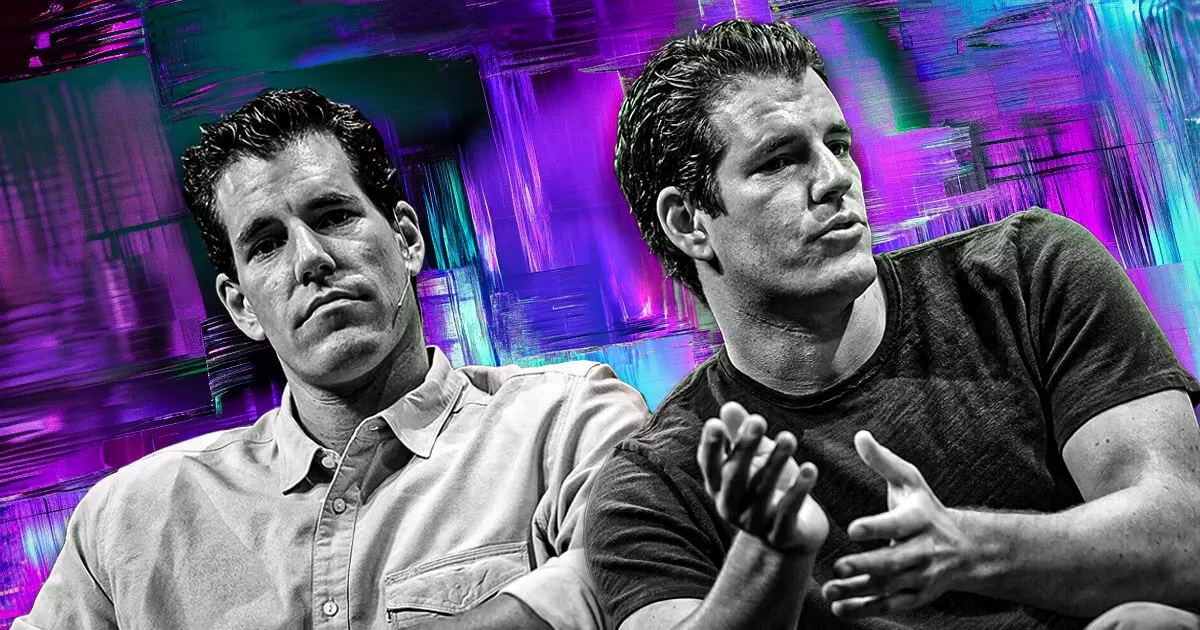

In a notable shift within the cryptocurrency landscape, Gemini, the prominent crypto exchange founded by the Winklevoss twins, has announced it will no longer hire graduates or interns from the Massachusetts Institute of Technology (MIT). This bold decision stems from MIT’s recent decision to rehire Gary Gensler, the former chair of the U.S. Securities and Exchange Commission (SEC), whose tenure is often associated with stringent regulatory measures against the crypto sector. Tyler Winklevoss articulated this dissociation on the social media platform X, firmly stating that as long as Gensler remains connected to MIT, the university’s graduates would be excluded from consideration for employment at Gemini.

Gemini’s refusal to engage with MIT graduates reflects a deeper discontent within the cryptocurrency community regarding regulatory practices. The Winklevoss twins have openly criticized Gensler’s regulatory approach, deeming his return to MIT a major miscalculation. Cameron Winklevoss’s remarks about Gensler emphasize a growing sentiment among some crypto advocates that past efforts to regulate the industry hindered, rather than helped, innovation. By identifying Gensler as a leading figure in “public policy failures,” the co-founders signal a broader rejection of affiliations with institutions that maintain ties with regulators perceived as antagonistic to their industry.

The controversy surrounding Gensler’s appointment as a Professor of Practice at MIT’s Sloan School of Management touches upon significant topics such as artificial intelligence, finance, and fintech. While Gensler’s expertise in these domains is unquestionable, his legacy at the SEC continues to loom large, particularly in the context of the crypto industry’s struggle for favorable regulatory conditions. Critics within the sector perceive this renewed connection between an influential academic institution and a figure viewed as unfavorable as a concerning trend that could stymie innovation and progress.

Responses to Gensler’s appointment have also emerged from other figures within the cryptocurrency space. Matt Huang of Paradigm has urged MIT-connected professionals in crypto to take a stand, potentially signaling a call for collective action against institutions welcoming ex-regulators. This sentiment was echoed by Caitlin Long, CEO of Custodia Bank, who articulated concerns over what might become a broader industry shift. Long’s observations raise pertinent questions: Is the crypto community beginning to mobilize against affiliations with academia that host former regulators? What does this mean for future collaborations between universities and cutting-edge industries?

A Shift in Trust and Collaboration

As the landscape of finance and technology continues to evolve, the relationship between academic institutions and the cryptocurrency sector is at a crucial juncture. The decision by Gemini to distance itself from MIT graduates signifies not only a rejection of a particular institutional relationship but also captures an ongoing tension between innovation and regulation. As firms within this space grapple with the implications of regulatory frameworks, the need for dialogue and cooperation with academic institutions may become increasingly tenuous if the foundational trust erodes further. In this context, Gensler’s association with MIT stands as a potent symbol of the clash between regulation and innovation—one that could shape the future dynamics of both academia and the burgeoning crypto industry.