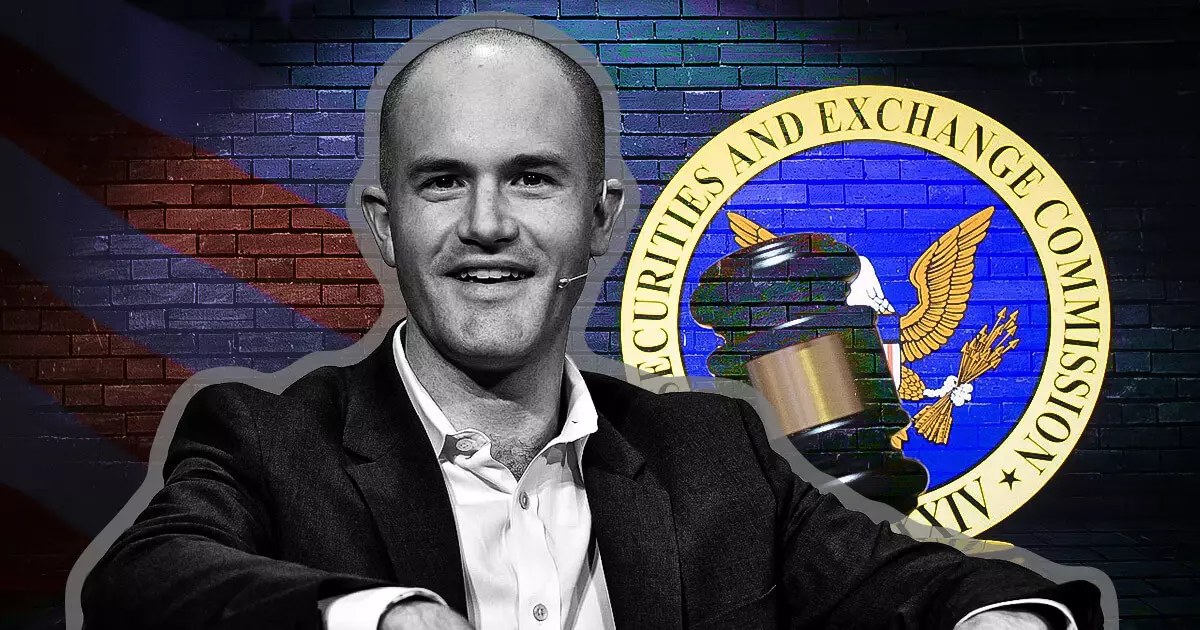

In a remarkable declaration made on December 3rd, Brian Armstrong, the CEO of Coinbase, revealed his company’s decision to cut ties with any law firms that employ former regulatory officials in what he perceives as a detrimental approach to the cryptocurrency industry. This move comes on the heels of former SEC Division of Enforcement Director Gurbir S. Grewal’s recent appointment to Milbank’s Litigation & Arbitration Group, prompting Armstrong to flag the firm as one Coinbase would no longer collaborate with. The crux of Armstrong’s argument revolves around a belief that some regulatory actions have been “unlawful” and harmful to the growth and development of the digital economy.

Armstrong’s criticism extends beyond mere disapproval; he points fingers at senior law firm partners, suggesting their ignorance regarding the cryptocurrency landscape contributes to malpractice. He specifically highlights Gurbir S. Grewal’s role in implementing policies he considers ethically questionable. Armstrong’s discontent with the previous SEC administration under Gary Gensler stems from what he describes as a lack of clear, actionable guidance on compliance matters, which he believes has resulted in a culture of fear among crypto innovators.

The CEO vocally declares, “This was not a normal SEC tenure,” positing that senior officials at the SEC during that time cannot simply claim innocence by stating they were “just following orders.” Instead, he argues they had the choice to exit their positions, a path taken by several reform-minded individuals who distanced themselves from the aggressive enforcement tactics that characterized the agency’s posture toward cryptocurrency.

In his statements, Armstrong does not advocate for the “permanent cancellation” of individuals but stresses the importance of the crypto sector distancing itself from those responsible for actions he views as detrimental. His direct appeal to other firms emphasizes that the hiring of individuals who contributed to regulatory suppression will inevitably cost legal firms clients, thereby exerting pressure on the legal landscape to reconsider its approach.

Following Armstrong’s announcement, Milbank’s silence signals potential apprehension regarding the implications of such a public critique. The exchange between Coinbase and regulatory entities underscores a broader, ongoing conflict in which the crypto industry feels besieged by regulatory frameworks that appear to hinder innovation rather than promote it.

This unfolding narrative encapsulates the profound rift between the cryptocurrency sector and regulators. Coinbase, being at the forefront of these legal skirmishes, has become a champion for clearer regulations that not only foster innovation but also create an enabling environment for the burgeoning industry. Armstrong’s firm stance represents a call for accountability within the legal system, placing an onus on the legal community to uphold ethical standards and engage constructively with the realities of crypto compliance.

The shift of regulatory figures into private practice, like Grewal’s move to Milbank, mirrors a trend that poses critical questions about conflicts of interest and ethical responsibility. As the cryptocurrency market continues to expand, such dynamics will undoubtedly shape the future landscape of digital finance and its regulatory framework.