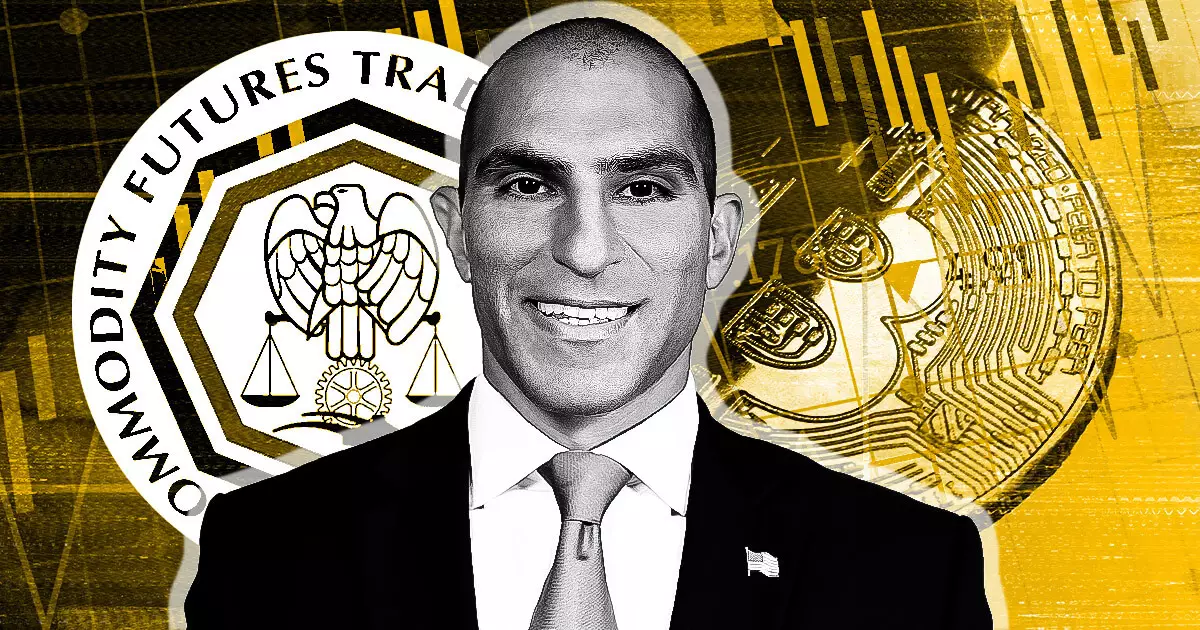

In a recent Senate Agriculture Committee hearing, CFTC chair Rostin Behnam expressed the agency’s willingness to take on the role of primary regulator for crypto assets. This statement signifies a potential shift in the regulatory landscape for digital commodities, as Behnam indicated that the CFTC has the necessary expertise and capacity to oversee this emerging market.

During the hearing, Senator Roger Marshall raised the question of whether it would be beneficial to designate the CFTC as the primary regulator for digital assets, with the SEC handling a smaller subset of related activities. Behnam’s response indicated that while the CFTC is open to assuming primary authority, there would need to be changes to existing definitions of securities and commodities to support this transition.

One of the key points of discussion was the potential for conflicting asset designations between the two regulatory bodies. Behnam acknowledged the possibility of facing lawsuits over such discrepancies but emphasized that cooperation between the CFTC and SEC could help address these concerns. He also highlighted the importance of establishing a contract listing system that aligns with existing regulatory frameworks to facilitate collaboration between the agencies.

Behnam outlined the CFTC’s goal of introducing tokens and contracts into regulated markets promptly to mitigate investor risks. He emphasized the need for a clear regulatory regime for cryptocurrencies, stating that a significant portion of the crypto market does not fit the definition of securities and therefore requires oversight from the CFTC. To support this initiative, Behnam proposed a budget of at least $30 million in the first year and $50 million in the second year to cover staffing, administration, and IT expenses, with user fees contributing to the funding.

Senator Cory Booker’s concerns over the urgency of establishing clear regulatory guidelines for cryptocurrencies were echoed by Behnam, who warned that without proper oversight, fraud and manipulation could continue to impact individuals in the US. Behnam’s stance highlighted the need for swift action to regulate the crypto market and protect investors from potential risks associated with unregulated digital assets.

The CFTC’s willingness to assume a more prominent role in regulating cryptocurrencies marks a significant development in the ongoing debate over the oversight of digital commodities. Behnam’s statements underscore the agency’s commitment to addressing the challenges posed by this rapidly evolving market and working collaboratively with other regulatory bodies to establish a coherent and effective regulatory framework for cryptocurrencies.