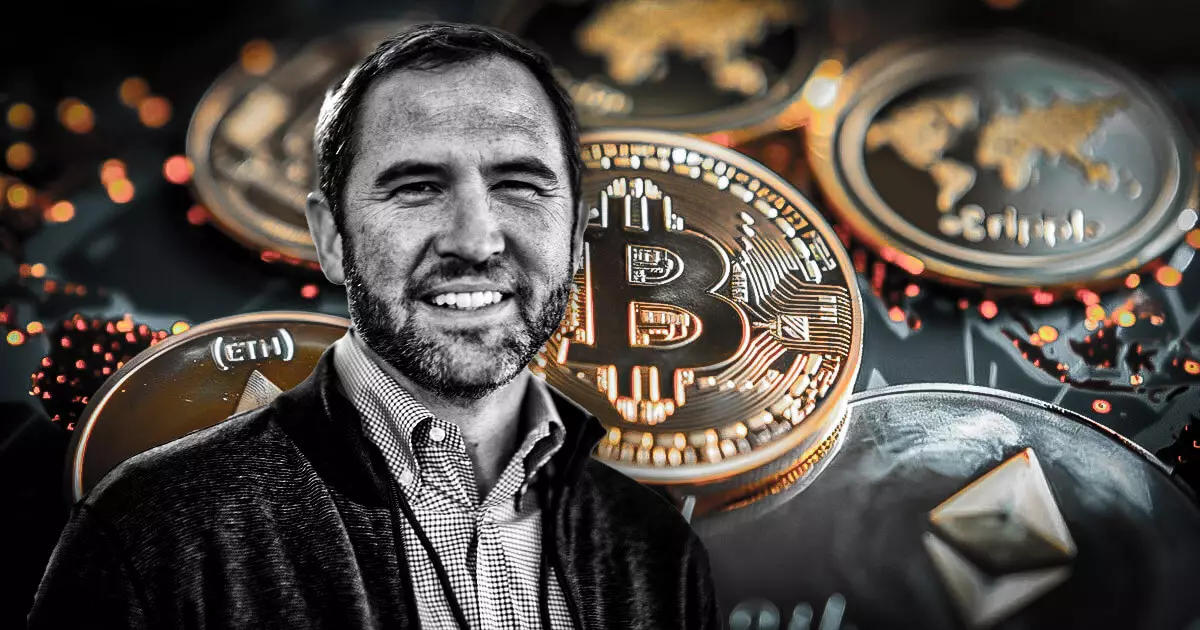

The cryptocurrency sector in the United States is experiencing renewed optimism over regulatory clarity, thanks to proactive discussions between industry leaders and government officials. Brad Garlinghouse, CEO of Ripple, recently affirmed this hopeful outlook following meetings with various lawmakers in Washington, D.C. In his reflections posted on February 13, 2023, Garlinghouse highlighted his interactions with influential policymakers like Senators Tim Scott and Chuck Schumer, along with Representatives French Hill, Ritchie Torres, and Bill Huizenga.

These conversations signify a pivotal moment for the crypto community, suggesting a bipartisan atmosphere focused on developing a comprehensive regulatory framework for digital assets. Garlinghouse noted a greater willingness among legislators to explore regulatory measures that foster innovation while maintaining market stability. This reflects a broader trend within the cryptocurrency industry, wherein key stakeholders are anticipating constructive changes under the current administration.

Positive legislative momentum has been observed, particularly regarding bills targeted at enhancing the oversight of stablecoins—one of the fastest-growing segments of the digital asset market. The House of Representatives is making strides with the STABLE Act, aimed at instituting robust licensing requirements and risk management approaches for stablecoin issuers. Meanwhile, the Senate is advancing the GENIUS Act, focusing on the establishment of foundational guidelines for innovation in stablecoin usage.

These legislative initiatives indicate a clear intent by Congress to define the parameters within which cryptocurrencies can operate, thereby fostering an environment conducive to economic growth. The proposals emphasize the need for transparency and accountability, ensuring that stakeholders are equipped with the necessary frameworks to navigate the evolving landscape of digital assets.

As Congress fine-tunes its approach to crypto regulation, key regulatory agencies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are also contributing to these discussions. Both bodies are tasked with striking a balance between ensuring market integrity and fostering economic innovation. The recent appointments of pro-crypto advocates to lead these agencies indicate a potential shift in how regulatory oversight will be approached moving forward.

Prominent appointments—such as Paul Atkins at the SEC and Brian Quintenz at the CFTC—signal a commitment to integrating an understanding of the crypto sector into regulatory frameworks. This transition could propel the cryptocurrency market into a new era, characterized by clear rules and a supportive environment for growth.

The dialogues initiated between the cryptocurrency sector’s leaders and U.S. lawmakers herald a transformative phase for digital assets. With the prospect of bipartisan legislation and active involvement from regulatory agencies, the future seems promising. The ongoing legislative efforts convey a willingness to embrace innovation while safeguarding the integrity of the market. For entrepreneurs and investors alike, this renewed environment could lead to substantial opportunities within the burgeoning world of cryptocurrency, ultimately fostering a more structured yet dynamic digital economy in the United States.