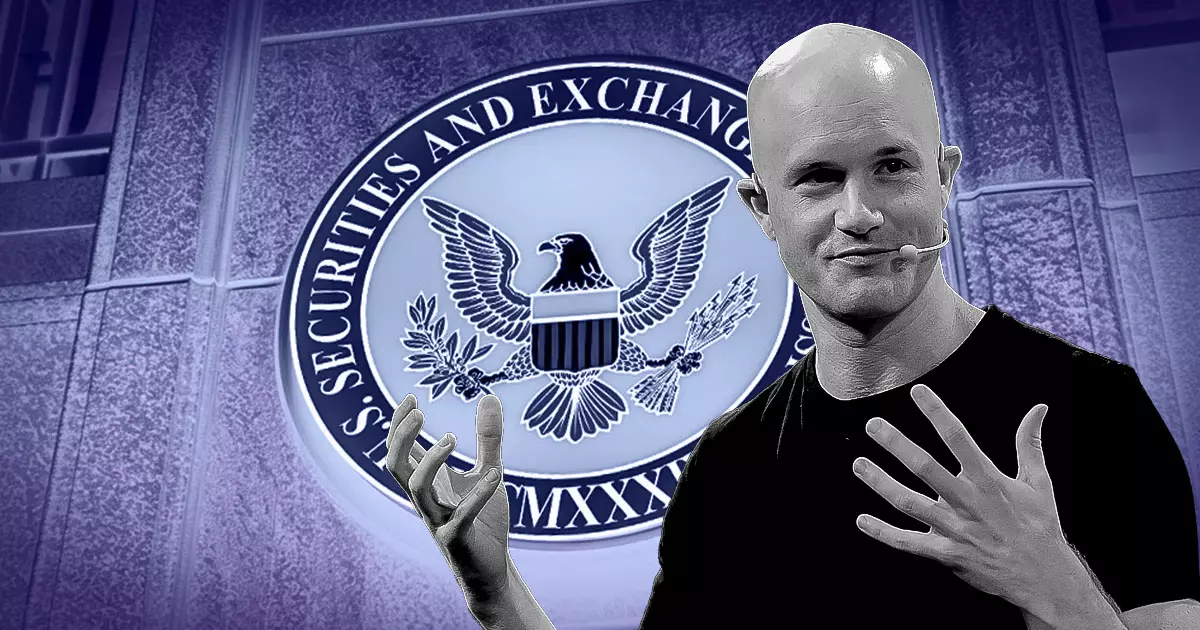

The ever-evolving landscape of cryptocurrency regulation has become a focal point of contention within the financial sector. As calls for clearer guidelines intensify, Coinbase CEO Brian Armstrong has recently spotlighted the troubling inconsistencies exhibited by the US Securities and Exchange Commission (SEC). His remarks, announced through a post on X, articulate a urgent appeal for the next SEC chair to correct course, retract what he labels as “frivolous” legal actions against crypto firms, and extend a public amends to the citizens of the United States. Armstrong’s advocacy is not simply a personal grievance; it taps into a broader sentiment in the cryptocurrency community regarding the urgent need for regulatory clarity.

Under the stewardship of Gary Gensler, the SEC has shown a pronounced inconsistency regarding its regulatory stance on digital assets. Armstrong underscores pivotal examples of these contradictions, particularly regarding the classification of cryptocurrencies as securities. For instance, the SEC asserted in 2018 that certain digital assets did not fall under the securities category, only to reverse this position by characterizing them as investment contracts in 2021. This back-and-forth not only causes confusion among investors but undermines the essential stability that regulatory frameworks are meant to provide.

The situation becomes even more intricate when examining the agency’s approach to Bitcoin. Initially classified as a non-security, the SEC’s vacillations culminated in a reaffirmation of this classification merely a year later, highlighting the ambiguity that has plagued regulatory discussions. Such inconsistency creates a precarious environment for cryptocurrency companies operating in an atmosphere laden with uncertainty regarding compliance.

Armstrong advocates for a symbolic yet significant gesture from the SEC—public apologies for its actions that have, according to him, diminished public trust in the institution. While it may seem that a mere apology cannot mend the perceived harm done, it represents a critical step towards accountability. The damage inflicted upon the industry by conflicting regulations can jeopardize innovation and investor confidence, both of which are vital for the thriving of this burgeoning market.

Moreover, the erratic nature of the SEC’s communications exacerbates calls for Gensler’s removal from office. The potential for political interventions into regulatory discussions, such as those voiced by Republican presidential hopeful Donald Trump, reflects growing bipartisan frustrations with the SEC’s perceived ineffectiveness.

As the cryptocurrency market yearns for a more predictable regulatory environment, Armstrong’s proposition resonates strongly not just with industry stakeholders but with anyone concerned about transparent governance. The call for clarity and consistency in the SEC’s regulatory practices is not merely a technical request; it embodies the fundamental demands for fairness and accountability within a sector marked by rapid transformation. Moving forward, establishing a constructive dialogue between regulatory authorities and the crypto community is essential for fostering an ecosystem that benefits all participants, ensuring innovation can flourish without the shadow of arbitrary enforcement.