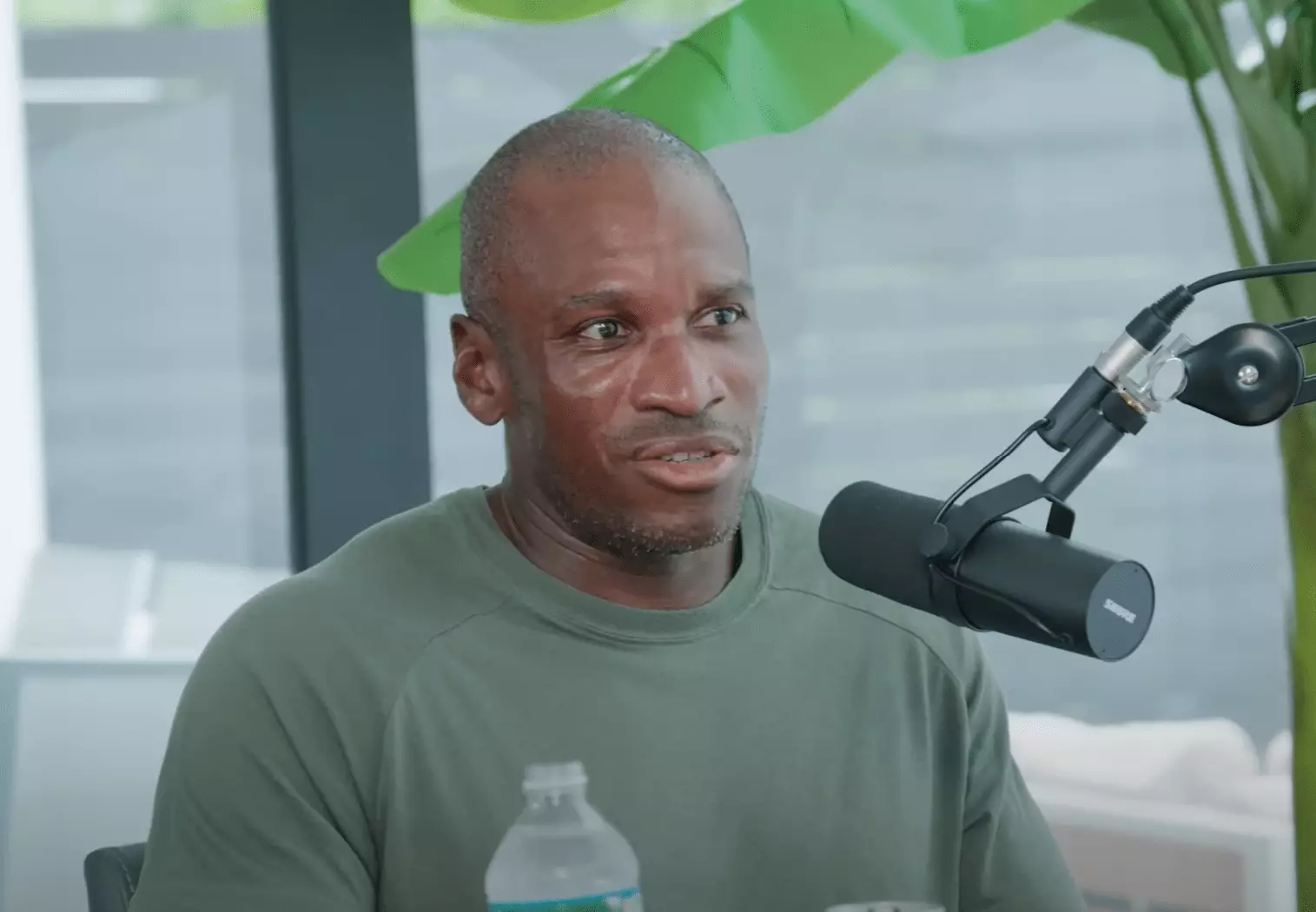

Arthur Hayes, a notable figure in the cryptocurrency space as the Chief Investment Officer at Maelstrom and co-founder of BitMEX, presents a nuanced analysis of Bitcoin’s trajectory in his latest essay titled “The Ugly.” Hayes argues that while the cryptocurrency market is rife with volatility, Bitcoin might experience a significant correction in the near future before ultimately achieving remarkable price heights. There’s an undeniable candidness in Hayes’s work, mirroring the unpredictable nature of financial markets. Through personal anecdotes and professional insights, he navigates the intricacies of economic indicators that currently send mixed signals to investors.

Hayes opens his narrative with a compelling metaphor, comparing financial analysis to skiing on a dormant volcano. This analogy aptly captures the looming threats within the market, emphasizing a sense of foreboding similar to what many experienced in late 2021, just before a notable downturn occurred. By revisiting these sentiments, he articulates his concern over current monetary conditions, which he perceives as precarious. It’s crucial to recognize that Hayes is not proclaiming the end of the bullish cycle; rather, he suggests that a recalibration towards cautious investing could be beneficial.

According to Hayes, Bitcoin may decline to the range of $70,000 to $75,000 before staging a robust comeback towards an ambitious target of $250,000 by the end of the year. This prediction is not whimsical but grounded in a careful examination of prevailing economic circumstances. He notes the intertwining of equities and treasury markets, both of which are existing in what he terms a “filthy fiat” ecosystem plagued by inflation. Such conditions heighten the risk of market corrections.

The author derives comfort from the strategy employed by his firm, Maelstrom, which plans to capitalize on lower Bitcoin prices by increasing its holdings in USDe stablecoins while remaining net long. This strategic positioning highlights a risk-management outlook—an essential approach amid the current financial volatility. The prospect of a 30% correction, as identified by Hayes, is not far-fetched; it reflects the broader trend where market trajectories are dictated by central bank policies and unexpected geopolitical shifts.

Hayes takes a deep dive into the roles played by major central banks, particularly those in the United States, China, and Japan. He argues that a tightening of monetary policy, whether through decreased money creation or increased interest rates, serves to restrict speculative investment, a dynamics that has characterized much of the crypto and equity market activity in recent months. This relationship is particularly critical as trends in treasury yields can significantly influence risk assets, including Bitcoin.

Delving into the complex interaction between U.S. fiscal policies and market reactions, Hayes notes the Federal Reserve’s signaling regarding its readiness to pivot should a financial crisis emerge. He perceives a potential tumultuous interlude could arise, influenced by political tensions involving Donald Trump and Jerome Powell, the chair of the Fed. Hayes articulates that the Fed’s reluctant policy adjustments may increase the potential for a bond market sell-off, which would ultimately spillover into equities and cryptocurrencies.

One of the more interesting assertions made by Hayes is his stance on the correlation between Bitcoin and conventional risk assets. As finance evolves, the narrative that Bitcoin exists outside of this sphere is being challenged. Recent trends show an increasing correlation with indices like the Nasdaq 100, undermining the argument that Bitcoin is a safe sanctuary against traditional market fluctuations. This emerging link suggests Bitcoin’s susceptibility to liquidity changes in broader fiat markets, especially in the short term.

Hayes presents Bitcoin as a potential leading indicator of market movements. If yields spike or equity markets spiral downward, Bitcoin might experience a downturn earlier than its traditional counterparts. Nevertheless, he posits that once monetary stimulus is reintroduced, Bitcoin could be the first asset to rebound, underscoring its volatile yet pivotal role in this evolving financial narrative.

In the face of uncertainty, Hayes emphasizes the importance of calculating probabilities rather than certainties in trading strategies. By adopting a defensive stance and preparing for possible price corrections, he believes investors can better position themselves to capitalize on tumultuous market conditions. This ‘expected value’ concept is central to his approach; it enables investors to gauge their risk-reward ratios effectively.

Hayes’s contemplation of a potential ‘Armageddon’ scenario, where altcoins may experience dramatic liquidation alongside Bitcoin’s dip, further illustrates the high stakes at play. His strategic foresight aims to ensure that if such events unfold, he will have the necessary resources to invest in fundamentally sound tokens at depressed valuations.

Arthur Hayes’s reflections provide a compelling case for a cautious but calculated approach to investing in Bitcoin. By recognizing the intricacies of market indicators and central bank policies, investors can navigate the complexities of the cryptocurrency landscape, poised for both challenges and opportunities ahead.