The cryptocurrency landscape has witnessed an unprecedented surge in the creation of new tokens, accelerating at a staggering rate that has the industry buzzing. Over 1 million new tokens are reportedly launched weekly, marking a new era of digital asset proliferation. This rapid innovation can be attributed to user-friendly platforms that enable individuals with limited technical expertise to create their own cryptocurrencies at the click of a button. Although this democratization of cryptocurrency creation opens doors for innovation, it also presents a complex challenge for existing token evaluation processes that are ill-equipped to handle such an influx.

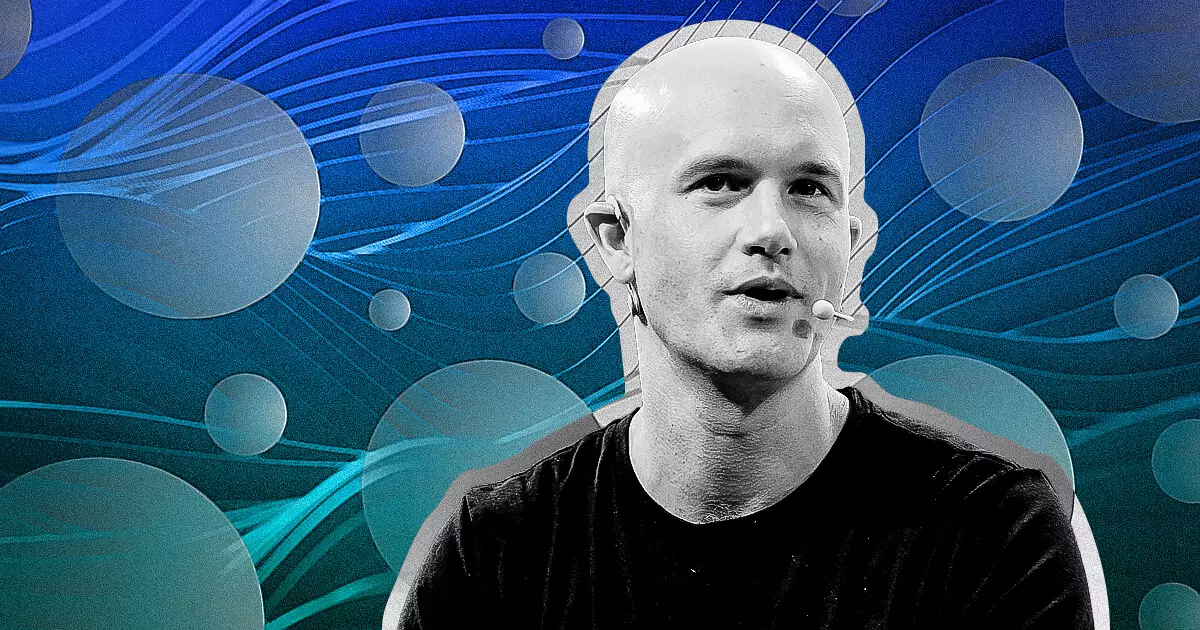

Coinbase’s CEO, Brian Armstrong, has strongly advocated for a re-evaluation of how tokens are listed and assessed on crypto exchanges. In a recent social media post, he brought attention to the weighty implications of this reality. Traditional methods of token approval rely on a centralized framework that examines each token individually—an approach that, according to Armstrong, is no longer sustainable. He suggests the adoption of a “block-list” system, wherein all tokens would be allowed by default unless flagged as potentially harmful. This revolutionary idea seeks to streamline the process and adapt to the fast-paced environment of cryptocurrency innovation.

Armstrong notes that transforming how tokens are listed is not merely beneficial but necessary for the ecosystem’s sustainability. By prioritizing user feedback and implementing automated data scans on the blockchain, the proposed system could create a more efficient means of identifying risks while maintaining accessibility. Such strategies could empower users and enhance the scalability of the cryptocurrency space.

The Regulatory Landscape: Need for Adaptation

As Armstrong tackles the intricacies of token listings, he also highlights the pressing need for regulatory bodies to evolve alongside technological advancements. He argues that existing frameworks do not adequately address the dynamics and complexities inherent in the current crypto environment. Armstrong urges both regulators and industry leaders to collaborate in formulating innovative solutions that not only protect investors but also foster continued growth and innovation.

He stresses that archaic methods of managing token approval cannot keep up with the vigorous pace of transformation taking place in the crypto market. The historical process of regulatory oversight over cryptocurrency has often lagged behind the developments and trends that shape the industry. Thus, a shift to a more agile regulatory framework will be essential for nurturing the sector while ensuring the safety of participants.

Beyond token listings and regulatory concerns, Armstrong’s vision for Coinbase extends into the seamless integration of decentralized exchange (DEX) options within the platform. His commitment focuses on providing users with an equitable experience, allowing them to navigate both decentralized and centralized trading opportunities without unnecessary complications. This strategic move aims to eliminate any barriers between different types of exchanges, making the blockchain ecosystem more intuitive and accessible.

There is a palpable recognition among industry leaders, including Armstrong, that the crypto market is at a pivotal juncture. As Coinbase positions itself at the forefront of this evolution, it is setting a precedent that may influence how other exchanges and platforms adapt to similar challenges. With a commitment to transparency, decentralization, and user empowerment, Coinbase aspires to create a trading environment that caters to the modern user’s needs.

The call for an overhauled token listing process reflects a larger narrative within the crypto community—a narrative characterized by the rapid innovation and the corresponding need for flexible frameworks. Armstrong’s insights underscore the delicate balance between fostering creativity and ensuring regulatory safeguards. As the world of cryptocurrencies continues to expand, the responsibility to adapt and evolve lies with both industry leaders and regulators alike. The future of cryptocurrency not only demands innovation but also the courage to transform established practices for a more resilient and equitable digital finance landscape.