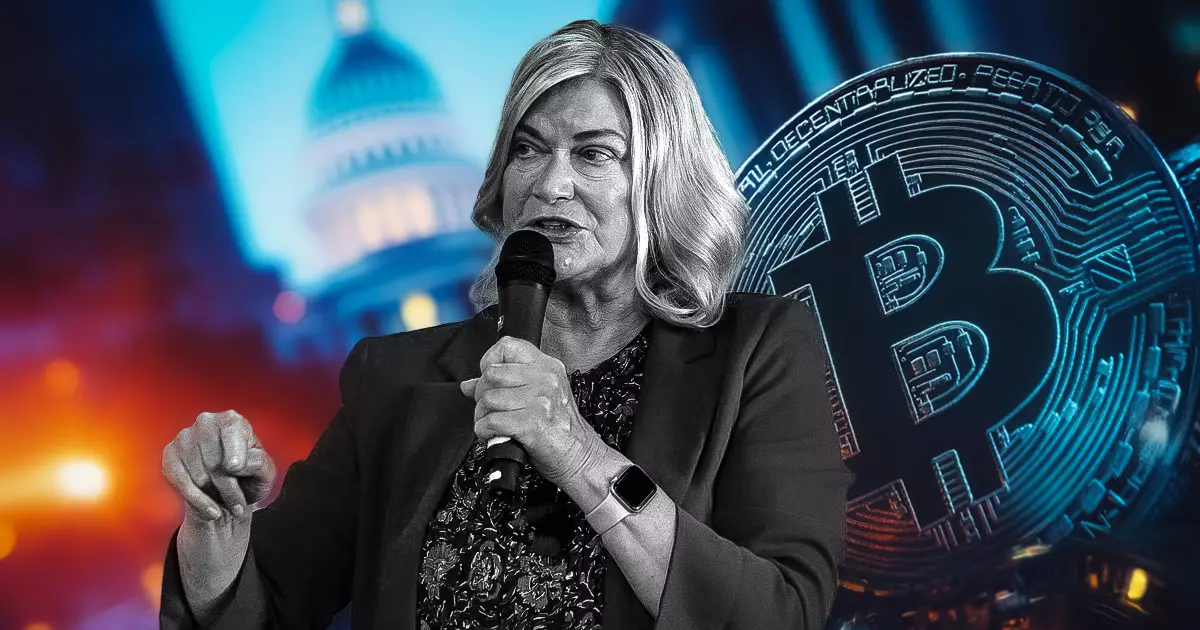

The recent establishment of the Senate Banking Subcommittee on Digital Assets marks a significant turning point in the United States’ engagement with blockchain technology and cryptocurrencies. Senator Cynthia Lummis (R-Wyo.) has been appointed as the inaugural chair, positioning her at the forefront of efforts to create a crucial regulatory framework for this rapidly evolving sector. This appointment, made public on January 23, by Senate Banking Committee Chair Tim Scott (R-S.C.), underscores the urgency lawmakers feel regarding the governance of digital assets.

Senator Lummis has emerged as a pioneering advocate for Bitcoin and other digital currencies. Her vision is clear: to place the U.S. at the vanguard of financial innovation. In her capacity as chair, Lummis argues for prompt bipartisan legislation that could define the regulatory landscape for these assets. “Digital assets are the future,” she asserts, acknowledging the potential they have to enhance the economic standing and innovation landscape of the country.

One of Lummis’s pivotal proposals includes the establishment of a national Bitcoin reserve, a strategic initiative that she believes could significantly enhance the strength and resilience of the U.S. dollar. This concept aligns with her previous legislative work, including the introduction of the Bitcoin Act during the Bitcoin 2024 conference in Nashville. By suggesting a national reserve, Lummis envisions a proactive approach to ensuring the United States does not fall behind in the global crypto race.

Beyond the national reserve, Lummis’s agenda will focus on essential components such as market structure, the regulation of stablecoins, and consumer protections. Her leadership will also involve supervising federal financial regulators to ensure compliance with emerging laws, thereby safeguarding against actions perceived as overreach, such as “Operation Chokepoint 2.0.” The establishment of this subcommittee signals a commitment to a measured and careful approach to regulation—an approach that balances innovation with consumer safety.

The bipartisan composition of the subcommittee is a testament to the importance of collaborative efforts in this politically charged arena. With members from both major parties, including Senators Thom Tillis (R-N.C.), Bernie Moreno (R-Ohio), and Ruben Gallego (D-Ariz.), the subcommittee aims to underline the necessity of cooperation in navigating the complexities associated with digital assets.

As the subcommittee begins its work, industry stakeholders have expressed optimism. Dennis Porter, co-founder and CEO of Satoshi Action Fund, characterized Lummis’s leadership as a vital advancement for bipartisan efforts regarding significant legislation, such as the Strategic Bitcoin Reserve. The excitement extends to figures like former Binance CEO Changpeng Zhao, who acknowledged the potential of the U.S. to adopt a Bitcoin reserve quickly.

With her feet firmly planted in the future of digital finance, Senator Lummis stands as a beacon for American innovation within the realm of cryptocurrencies. As her leadership unfolds, the establishment of a robust legal framework could provide the necessary backbone for both the industry’s growth and the protection of consumers. In a landscape defined by rapid technological advancements, the role of policymakers has never been more critical, and the eyes of the crypto world are keenly focused on the outcomes of the newly formed Senate Banking Subcommittee on Digital Assets. As the legislative process progresses, it will be intriguing to witness how these initiatives shape not just the future of digital assets, but the fabric of American finance as a whole.