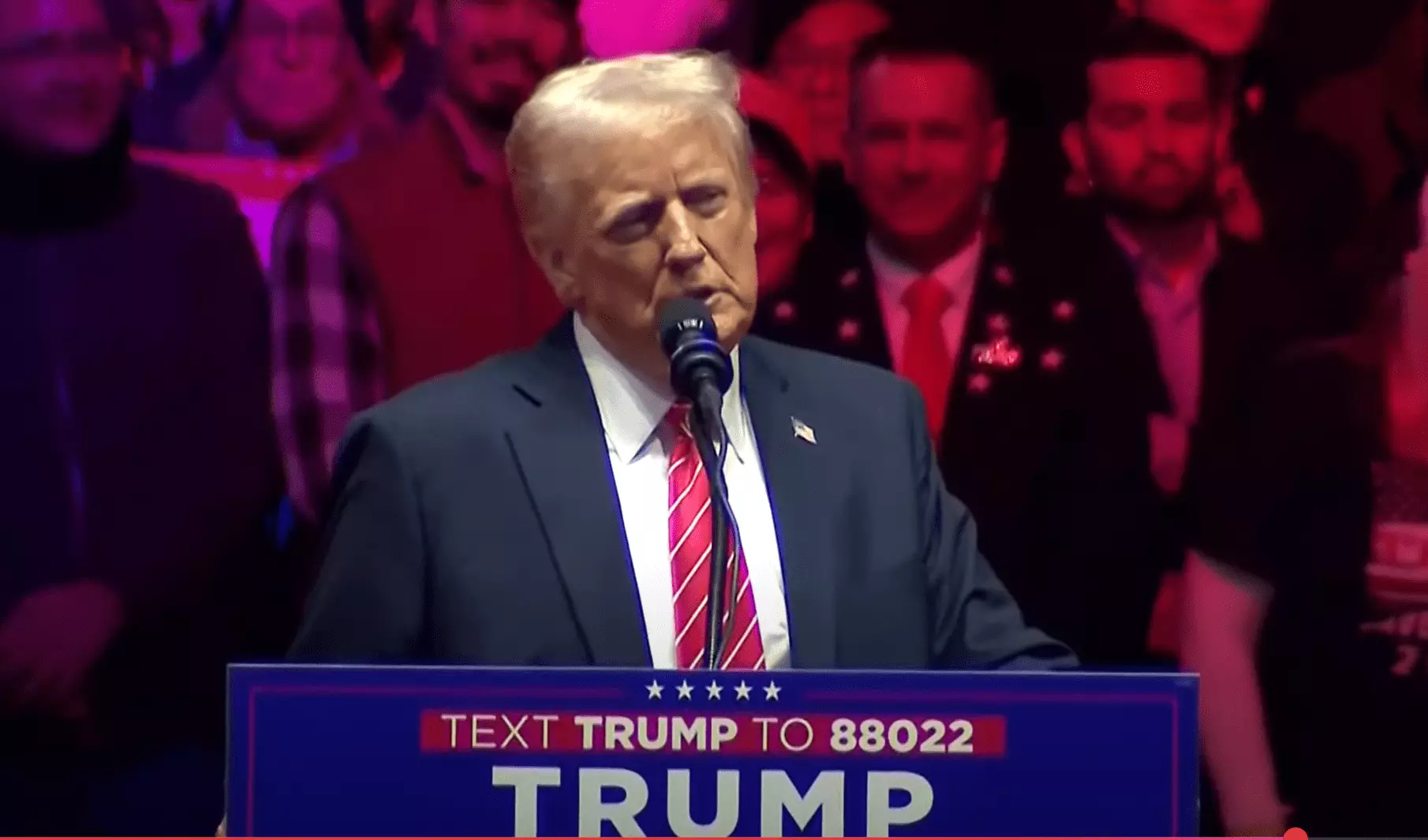

The cryptocurrency market is notorious for its volatility, and Bitcoin has once again proven its unpredictable nature by reaching an unprecedented all-time high of $109,558. This remarkable surge coincided with a significant political milestone: the inauguration day of President Donald Trump. This timing has led market watchers to speculate on the intertwining of politics and cryptocurrency, particularly concerning the emergence of a Strategic Bitcoin Reserve (SBR). The possibility that such a reserve could be established through executive action has ignited discussions among traders and investors alike, marking a pivotal moment for both Bitcoin and its integration into governmental operations.

Rumors and predictions have long surrounded the idea of the U.S. government implementing a Bitcoin reserve under Trump’s administration. Notably, the prediction market Polymarket reflected a sharp increase in the likelihood of this occurring within the first hundred days of his presidency, reaching odds of 59%. This increase mirrored Bitcoin’s climb to its new peak, suggesting an intricate relationship between market speculation and political developments. Past comments from Trump about potentially consolidating Bitcoin seized by law enforcement into a government reserve have laid the groundwork for such speculation, even in the absence of formal announcements.

In the lead-up to Trump’s inauguration, several notable figures from the cryptocurrency sector engaged directly with the incoming administration, further intensifying discussions around the SBR. Senators John Barrasso and Cynthia Lummis, both vocal advocates for Bitcoin, have actively promoted the integration of cryptocurrency into governmental legislation. Lummis, in particular, has been vocal on platforms like X (formerly Twitter), pushing for comprehensive legislation, including her proposal to acquire a million Bitcoins for a government reserve.

Meanwhile, influential business leaders like Michael Saylor, Chairman of MicroStrategy, have forged connections with Trump’s administration, emphasizing a prevailing belief that the political climate is increasingly favorable for Bitcoin and its advocates. Images shared on social media by these individuals signify a collaborative effort aimed at enhancing Bitcoin’s standing on a national level, with excitement building around potential legislative advancements.

The Implications of a Strategic Reserve

Should the U.S. establish a Strategic Bitcoin Reserve, it would represent a groundbreaking shift in the way national governance interacts with digital currencies. Some analysts, like Charles Edwards from Capriole Investments, believe that the rapid price action of Bitcoin may be indicative of a larger, more sustainable trend. Edwards interprets this volatility as a potential precursor to further significant gains, supporting the notion that positive news and anticipated government actions could bolster institutional investment in cryptocurrency.

Moreover, the suggestion that the formation of this reserve could enable a new wave of “crypto activism” among Trump’s supporter base hints at the profound societal implications of such a move. If the government openly embraces Bitcoin, it might not only solidify the cryptocurrency’s legitimacy but could also lead to its wider acceptance among the American populace, bridging the divide between traditional finance and blockchain technology.

Market Dynamics and Future Predictions

Despite the optimism surrounding Bitcoin’s current trajectory, industry analysts remain cautious. The cryptocurrency market is characterized by extreme fluctuations, often influenced by both external events and market psychology. Investors are advised to proceed with caution, recognizing that while there may be ample potential for Bitcoin and broader cryptocurrency acceptance in the U.S., the sector remains fraught with uncertainty. The unpredictable nature of market sentiment could lead to drastic price adjustments at any time, emphasizing the need for diligent research and strategic planning for any prospective investments.

As Bitcoin trades at approximately $108,182 at the time of writing, traders and policymakers alike are on high alert. The possibility of integrating a government-held reserve of Bitcoin holds transformative potential, but the political landscape is also dynamic and fraught with potential challenges. The coming weeks and months will likely provide further clarity regarding Trump’s cryptocurrency ambitions and their implications for the digital currency landscape.

Bitcoin’s recent ascent is not merely about market dynamics; it represents the intersection of financial innovation and political strategy. As discussions around the establishment of a Strategic Bitcoin Reserve gain momentum, it is crucial for stakeholders to engage thoughtfully with the evolving framework surrounding cryptocurrencies. The historical nature of this convergence may signal a new chapter for Bitcoin, one in which it becomes not only a financial asset but also a cornerstone of national economic policy, laying the groundwork for a more integrated future between government and cryptocurrency.