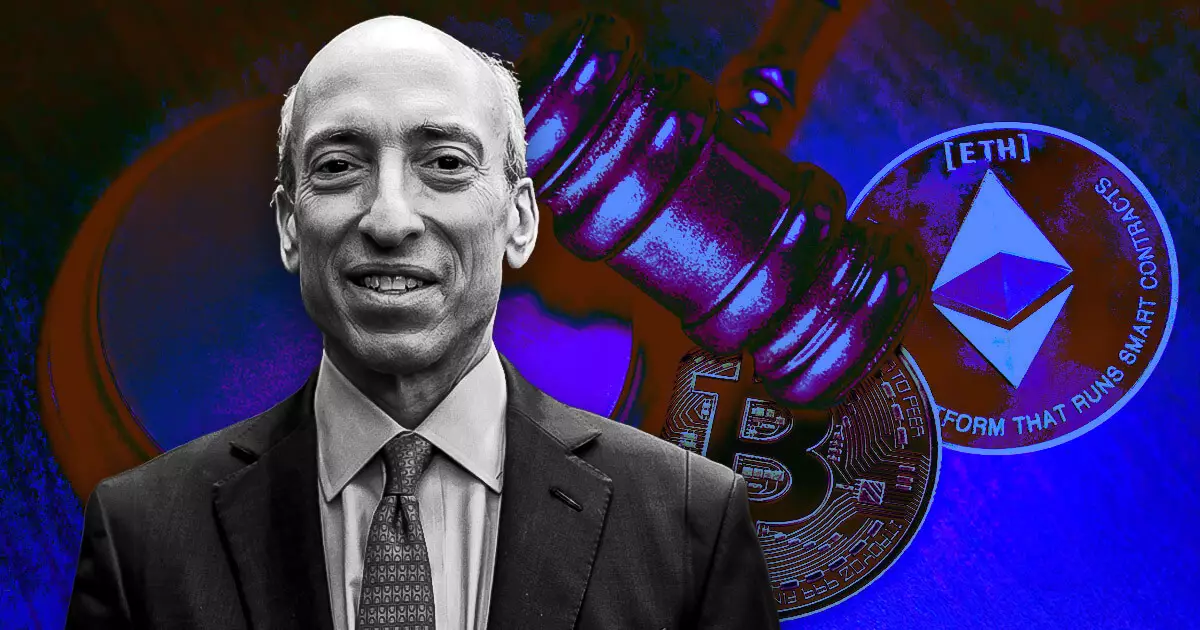

The United States Securities and Exchange Commission (SEC) is poised to reject two proposed exchange-traded funds (ETFs) linked to Solana (SOL), as indicated by insights from Bloomberg ETF analyst Eric Balchunas. This news has been solidified by reports from Fox News, suggesting that the decision represents current SEC Chair Gary Gensler’s last significant intervention in the crypto sector before his impending departure. Gensler’s term is set to end on January 20, 2025, a timeline that has sparked discussions about the future of cryptocurrency-related regulations under a new administration, with Paul Atkins poised to take over.

Balchunas characterizes these rejections as Gensler’s “parting gift” to the crypto ecosystem, suggesting a shift in regulatory focus and potentially highlighting an impending change in the SEC’s attitude toward digital assets. As the crypto industry continues to navigate a complex regulatory framework, these developments raise essential questions regarding the agency’s stance on digital assets and market stability.

The anticipated rejections of the Solana ETFs are not merely a reflection of Gensler’s regulatory policies but also indicative of broader issues within the SEC’s operational ethics. Fellow Bloomberg analyst James Seyffart emphasizes that granting approval for SOL-based ETFs would contradict the SEC’s current legal position, which regards Solana as a security amid various lawsuits. This contradiction adds a layer of complexity to the ongoing discourse on cryptocurrency classification and regulation.

The lingering ambiguity around how cryptocurrencies are categorized complicates the SEC’s ability to foster innovation within the sector while simultaneously protecting investors. This juxtaposition highlights an alarming stagnation in the marketplace, as Seyffart points out that any new applications may remain “dead in the water” until the newly appointed SEC chair lays out a distinct regulatory vision.

Looking ahead, it seems that Solana ETF issuers may regroup and resubmit their applications following the anticipated transition in SEC leadership. This potential re-filing aligns with prevailing sentiments among industry insiders like Gabor Gurbacs, who notes that Gensler’s retreat is on the horizon. Nonetheless, Seyffart tempers optimism by suggesting that any hopeful timelines for approval may be significantly delayed; his previous estimate for potential approval in August 2025 is now a cautious prediction, contingent upon changing regulations.

Another point of contention in this evolving narrative is the SEC’s recently filed brief in the case involving Binance. Notably, Stuart Alderoty, Ripple’s Chief Legal Officer, pointed to this document as a pivotal piece showcasing the SEC’s commitment to rigorous enforcement against perceived violations. The agency’s focus on cases like Binance exemplifies the idea that the SEC remains vigilant in its duty to regulate the crypto space, even as the winds of change loom with the potential new leadership.

The SEC’s anticipated rejection of Solana ETFs serves as a significant indicator of the current regulatory climate surrounding cryptocurrencies. With Gensler’s exit just around the corner, the crypto community is left to speculate on the future direction of the SEC under its new leadership. As issues of regulation and classification continue to unfold, the tumultuous landscape of digital assets demands careful navigation, and only time will reveal how the SEC addresses its challenges in harmonizing innovation with investor protection.