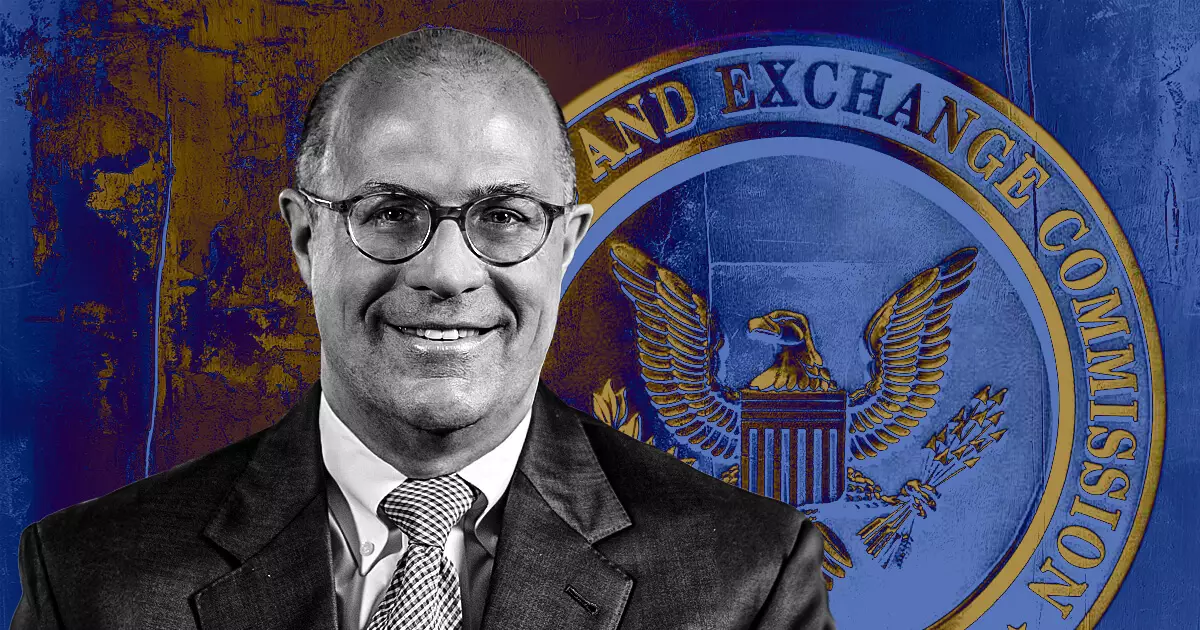

In the ever-evolving landscape of cryptocurrency regulation in the United States, former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo has recently found himself at the center of speculation regarding potential roles at the Securities and Exchange Commission (SEC) and the U.S. Treasury Department. Giancarlo, affectionately dubbed ‘Crypto Dad’ for his supportive stance on the accessible integration of digital currencies since 2018, publicly refuted these claims. His denial sheds light on the tumultuous atmosphere surrounding cryptocurrency regulations, especially in a climate where the SEC has been accused of an ambiguous and aggressive approach to enforcement.

Giancarlo’s comments implied his disdain for the current regulatory climate created by SEC Chair Gary Gensler, specifically alluding to what he described as a “mess.” This term likely denotes the SEC’s controversial “regulation by enforcement” strategy, which targets crypto firms through lawsuits rather than establishing clear guidelines for compliance. Such tactics, which have led to significant pushback from various market participants, raise critical questions about the efficacy and ethics of regulatory practices in a rapidly advancing technology sector. Gensler’s attempts to label many digital assets as securities further complicate matters, as they impose a complex bureaucratic framework on entities hoping to innovate within the space.

As the SEC has moved aggressively against a variety of crypto companies—including major players like Ripple and Coinbase—the voices advocating for clearer regulations have grown louder. Critics argue that the SEC’s approach neglects to create a supportive framework for responsible cryptocurrency adoption. Giancarlo’s earlier advocacy for the industry hinged on the belief that cryptocurrencies were “here to stay,” signaling the urgent need for regulations that foster innovation rather than stifle it under a thick blanket of enforcement actions.

With Gensler asserting that a significant proportion of the thousands of existing digital assets could qualify as securities under U.S. law, the ambiguity intensifies. This ambiguity leads to a labyrinth of legal interpretations that can deter investment and innovation. Gensler’s stance emphasizes a protective approach directed at preventing “significant investor harm,” an argument that some proponents in the crypto community see as overly restrictive and potentially harmful to the industry’s growth.

Future Implications for Cryptocurrency Regulation

As the debate over the regulatory landscape continues, Giancarlo remains engaged in advisory roles focused on nurturing the development of digital currencies. Meanwhile, Gensler’s firm regulatory posture has drawn criticism and raised questions about the future of the SEC’s interactions with the crypto world. The outcome of ongoing legal battles and the overall regulatory environment will undoubtedly shape the trajectory of the cryptocurrency industry in the United States.

As Giancarlo distances himself from potential regulatory roles, the key takeaway remains the intensified demand for clarity and collaboration between regulators and industry stakeholders. To foster a healthy environment for cryptocurrency innovation, constructive dialogue and strategic frameworks must replace the current reliance on litigation and enforcement. Absent such efforts, the future viability and evolution of digital assets in America risks being stifled.