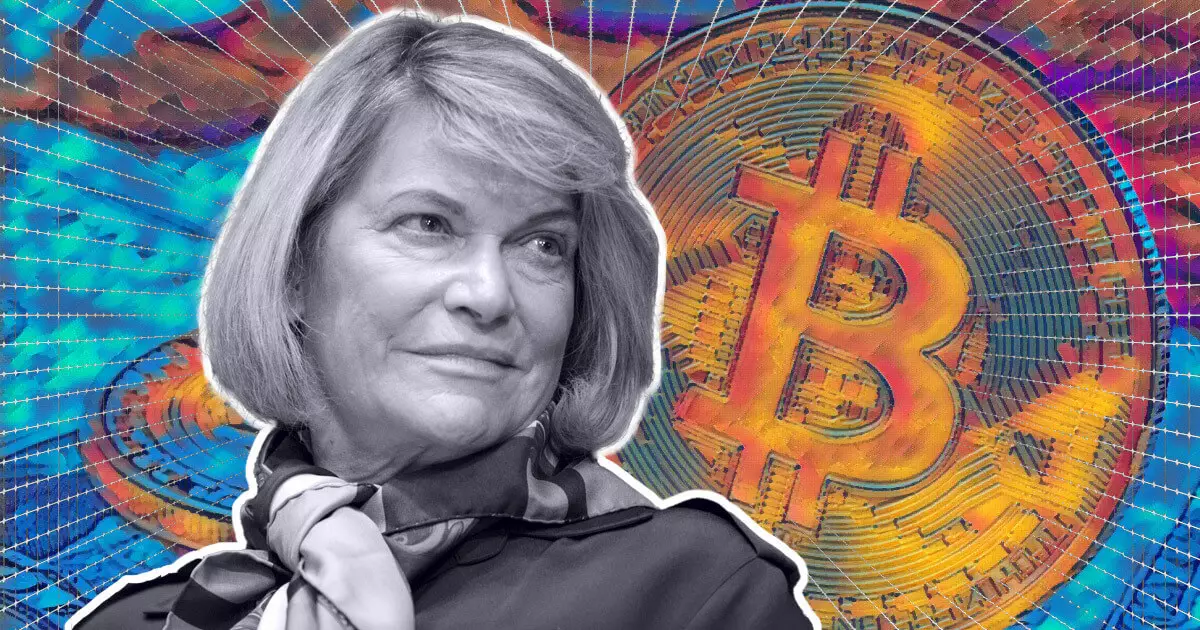

US Senator Cynthia Lummis (R-WY) recently introduced the “Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act” in the Senate with the aim of supercharging the US dollar and paying down the national debt through the establishment of a strategic Bitcoin reserve.

The BITCOIN Act proposes the creation of a Strategic Bitcoin Reserve to manage the Federal Government’s Bitcoin holdings transparently. It also aims to protect the private property rights of individuals and organizations. Additionally, the legislation outlines the establishment of a decentralized network of secure Bitcoin vaults operated by the US Department of Treasury. These vaults will ensure the highest levels of physical and cybersecurity for the nation’s Bitcoin holdings.

One of the significant aspects of the BITCOIN Act is the implementation of a Bitcoin purchase program. This initiative will acquire up to 1 million Bitcoins over a set period, approximately 5% of the total Bitcoin supply. The size and scope of this program mirror the US gold reserves, highlighting the importance of Bitcoin as a store of value.

To fund the establishment of the Strategic Bitcoin Reserve, the Act will diversify existing funds within the Federal Reserve System and the Treasury Department. This approach aims to offset costs without placing additional financial burdens on the government. Importantly, the BITCOIN Act affirms the self-custody rights of private Bitcoin holders and ensures that the strategic Bitcoin reserve will not infringe upon individual financial freedoms.

The Act mandates the creation of a quarterly Proof of Reserve system to ensure transparency. This system will include public cryptographic attestations and independent third-party audits. Additionally, the Treasury Secretary will publish annual public reports on the status of the Bitcoin Purchase Program, detailing total holdings, transactions, and the control of private keys related to the Strategic Bitcoin Reserve.

The BITCOIN Act seeks to enhance financial resilience and promote global financial innovation by diversifying national assets to include Bitcoin. The introduction of this legislation represents a significant step toward integrating digital assets into the US’ financial strategy, reflecting a forward-looking approach to financial innovation and security.

The BITCOIN Act introduced by US Senator Cynthia Lummis is a groundbreaking proposal that aims to supercharge the US dollar and pay down the national debt through the establishment of a strategic Bitcoin reserve. By recognizing the importance of Bitcoin as a store of value and promoting financial innovation, this legislation represents a significant step forward in embracing digital assets in the US financial system.