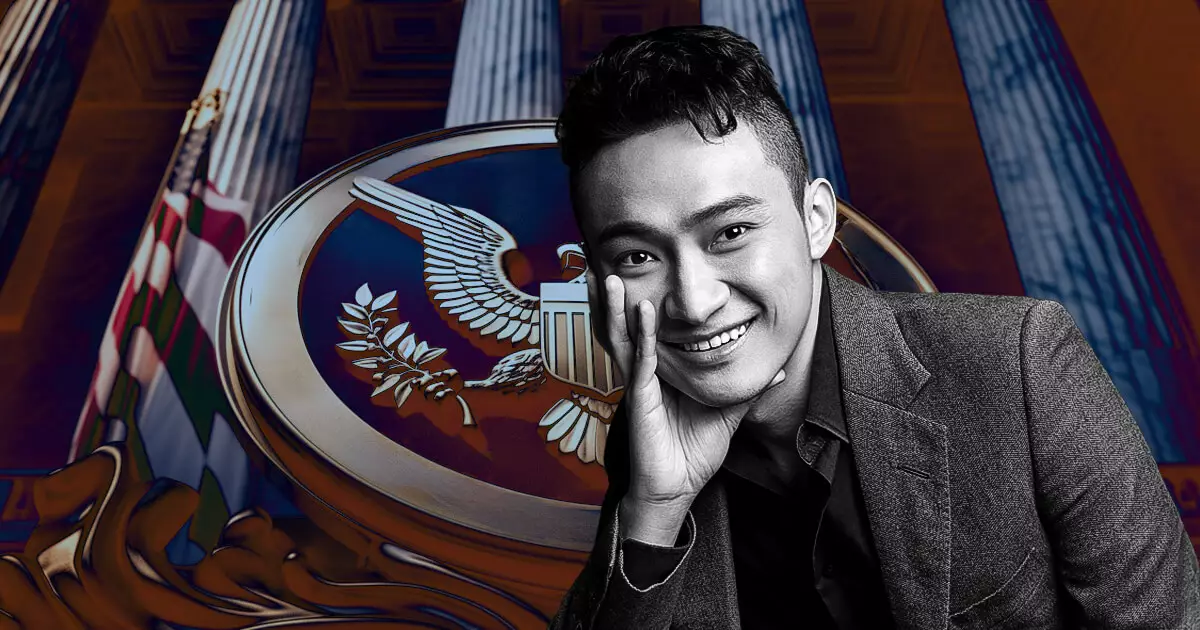

The US SEC recently filed an amended complaint in its case against Justin Sun and other defendants, alleging that Sun’s frequent visits to the United States should establish the jurisdiction necessary to proceed with legal action. According to the regulator, Sun spent a significant amount of time in the US between 2017 and 2019, conducting business trips to major cities such as New York City, Boston, and San Francisco on behalf of the Tron Foundation and the BitTorrent Foundation, both of which are named as defendants in the case. The SEC aims to use these visits as a basis for claiming jurisdiction over Sun and the companies to pursue regulatory and legal action in the US.

Wash Trading Scheme Allegations

In addition to the jurisdictional claims, the SEC’s amended complaint also accuses Sun and the companies of engaging in a wash trading scheme on the now-defunct crypto exchange Bittrex. While the original complaint did not explicitly name Bittrex, the amended complaint clarifies that the exchange is based in the US, adding to the SEC’s rationale for jurisdiction. Furthermore, the SEC alleges that Sun personally communicated with Bittrex in 2018 to facilitate the listing of the TRX crypto, linking him directly to the companies involved.

Sun’s defense lawyers previously argued that he, being a foreign national, should not be subject to the SEC’s jurisdiction based on his visits to the US. However, the SEC’s latest allegations directly address these concerns, shedding light on Sun’s personal involvement with US-based exchanges and companies. The request for dismissal also challenged the SEC’s claims of improper distributions on Bittrex, emphasizing that there was no evidence of US residents purchasing TRX on the platform in question.

The SEC initially sued Sun and the other defendants in March 2023, citing specific personal jurisdiction claims related to investor focus in the Southern District of New York and celebrity promoters’ interactions with individuals in the US. Subsequently, the SEC separately sued Bittrex in April 2023, which ultimately led to a settlement in August 2023. Following the legal proceedings, Bittrex ceased global operations by the end of 2023, marking a significant development in the aftermath of the SEC’s actions.

Through the amended complaint, the SEC continues to bolster its case against Justin Sun and the implicated companies, highlighting the alleged jurisdictional basis, wash trading activities, and personal involvement of the defendants. The evolving legal saga reflects the complexities of regulating cryptocurrency transactions and holding individuals and entities accountable for their actions within the rapidly evolving digital asset landscape.